General

Advantages

Compare products

Credit line

Up to AMD 250 000 or USD 500 000

Low interest rate - Starting as low as 8.9%

Low Commission fee - Starting as low as 0.5%

Energy loan

EIAA

Business mortgage

Further saving - Saving due to energy-efficient system

Starting as low as 8.5%

Low Commission fee - Starting as low as 0.5%

The loan product is available in AMD and USD

Starting as low as 8%

The loan product is available in AMD and USD

The loan product is available in AMD and USD

Starting as low as 8.5%

Maximum 180 months

Special offer

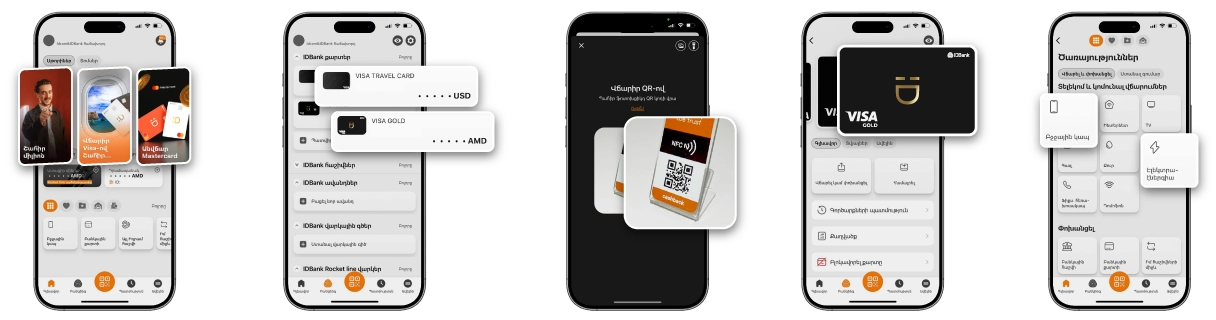

Package "IDBusiness Shoppy Overdraft"

Accept non-contact payments through Idram system and use the privileged overdraft package. Get an overdraft of up to AMD 50,000,000, as well as a Visa Business payment card with one year of free service, a free AMD account and much more.

Purpose of credit line

Acquisition of working capital, financing of accounts payable, acquisition of fixed assets by legal entities, individual entrepreneurs, residents

non-residents of the RA, as well as individuals, residents

non-residents of the RA, who are engaged in agriculture

non-residents of the RA, as well as individuals, residents

non-residents of the RA, who are engaged in agriculture

Type of credit line

Revolving or non-revolving credit line

Customer class

micro, small/medium, large

Currency

AMD / USD

Minimum amount

micro: 5,000,000 AMD 10,000 USD,

small/medium: 5,000,000 AMD 10,000 USD,

large: 5,000,000 AMD 10,000 USD

small/medium: 5,000,000 AMD 10,000 USD,

large: 5,000,000 AMD 10,000 USD

Maximum amount

micro: 25,000,000 AMD 50,000 USD,

small/medium: 25,000,000 AMD 50,000 USD,

large: according to internal regulations

small/medium: 25,000,000 AMD 50,000 USD,

large: according to internal regulations

Minimum maturity

12 months

Maximum maturity

36 months

Annual interest rate

micro: AMD: from 14% USD: from 12%,

small/medium: AMD: from 11.5% USD: from 10%,

large: AMD: from 11% USD: from 8%

small/medium: AMD: from 11.5% USD: from 10%,

large: AMD: from 11% USD: from 8%

Annual actual rate

micro: AMD: from 15.18% USD: from 12.92%,

small/medium: AMD: from 12.36% USD: from 10.69%,

large: -

small/medium: AMD: from 12.36% USD: from 10.69%,

large: -

Loan application processing fee

N/A

Up-front fee

0.5-1 % of the credit line amount, but no less than 50,000 AMD, single payment

Monthly service fee

N/A

Repayment of used principal amount of the credit line and the interest amount

1. For credit line provided to the bank account: repayment of the used part of the credit line can be made monthly, quarterly or on semiannual basis, at the maturity or other frequency

Annual interest rate calculated to undrawn part of the credit line

Up to 2%

Minimum term of business history (uninterrupted)

12 month

Opening/maintenance of bank account

According to tariffs

How the credit line is provided 1. non-cash, through transferring on bank account according to the applicable rates

withdrawal of the facilities from the bank account is according to applicable tariffs.

2. through transferring to visa business payment card, according to applicable tariffs.

2. through transferring to visa business payment card, according to applicable tariffs.

Eligible age

Age of physical persons and persons having the status of private entrepreneurs must not exceed 70 at the maturity

Requirements to the credit history of the borrower (including persons owning 10 % and more in the charter capital thereof) / guarantor

1. No overdue/classified obligations as of the date of loan,

2. Good or neutral credit history acceptable by the Bank, according to internal legal acts of the Bank,

3. Competent authorities of the Bank may decide to make requirements to other participants, as well as persons closely related with the borrower

2. Good or neutral credit history acceptable by the Bank, according to internal legal acts of the Bank,

3. Competent authorities of the Bank may decide to make requirements to other participants, as well as persons closely related with the borrower

Acceptable means of security/Pledge

• Real estate,

• Fixed assets/equipment, techniques, other property,

• Vehicles,

• Working assets,

• Right of receivables,

• Financial flows,

• Guarantees, warranties,

• Monetary means,

• Precious metals (goods),

• Shares,

• Securities,

• Right to collateral,

• Other property not prohibited by the RA legislation or property right

• Fixed assets/equipment, techniques, other property,

• Vehicles,

• Working assets,

• Right of receivables,

• Financial flows,

• Guarantees, warranties,

• Monetary means,

• Precious metals (goods),

• Shares,

• Securities,

• Right to collateral,

• Other property not prohibited by the RA legislation or property right

Credit line limit/collateral ratio

By decision of the competent authority of the Bank, the maximum rate is 50-100%, depending on the type of collateral (in the case of loans secured by collateral). By decision of the competent authority of the Bank, a loan can be provided without collateral or simultaneously with other collateral (guarantee, financial flows, property rights, etc.).

Insurance of subject of collateral

Under the decision of the competent authority of the Bank, collateral insurance may be required based on the loan balance or the estimated market / realizable value of the property.

Fine, penalty

Fine for overdue credit line amount -0.1% daily.

Fine for overdue interest amount - 0.1% daily.

No penalty is imposed for early termination of the credit line agreement in case of credit lines up to AMD 5,000,000 or the equivalent in foreign currency (except for large class clients).

In other cases, 3% of the early repayment amount may be charged.

Fine for overdue interest amount - 0.1% daily.

No penalty is imposed for early termination of the credit line agreement in case of credit lines up to AMD 5,000,000 or the equivalent in foreign currency (except for large class clients).

In other cases, 3% of the early repayment amount may be charged.

Where to apply

Bank’s branches, Head office

Signing the main loan agreement

At the request of the client, a main loan agreement can be concluded with him for a period of up to 240 months.

Provision factors

1) Positive credit history,

2) Stable cash flows,

3) Compliance of the collateral with the requirements of the Bank,

4) Good reputation,

5) Other factors

2) Stable cash flows,

3) Compliance of the collateral with the requirements of the Bank,

4) Good reputation,

5) Other factors

Rejection factors

1) Negative credit history,

2) Insufficient financial situation,

3) Non-compliance of the collateral with the requirements of the Bank,

4) Providing false or inaccurate information,

5) Providing information that calls into question the return of the loan,

6) Other factors

2) Insufficient financial situation,

3) Non-compliance of the collateral with the requirements of the Bank,

4) Providing false or inaccurate information,

5) Providing information that calls into question the return of the loan,

6) Other factors

Maximum term of making decision

Up to 15 business days after submitting full pack of required documents

Validity term of the decision

30 days

Terms of re-approval

Maximum once, within 10 business days after expiration of the term of decision, under terms of crediting applicable as of the date of re-approval

Term of providing credit line

Maximum 3 business days after the submission of the decision on the provision of a credit line and the provision of the right of pledge after registration, if the client has not expressed a desire to receive a loan later, observing the period specified in clause 29.

Information regarding credit history and credit score

You can learn about the importance of credit history and credit score here․

Details via abcfinance.am and acra.am links.

Details via abcfinance.am and acra.am links.

Apply now

Interest rate starting at 8.9%

Loan amount till 250,000,000 ֏

Credit-line.pdf

Credit-line.pdf