General

Advantages

Compare products

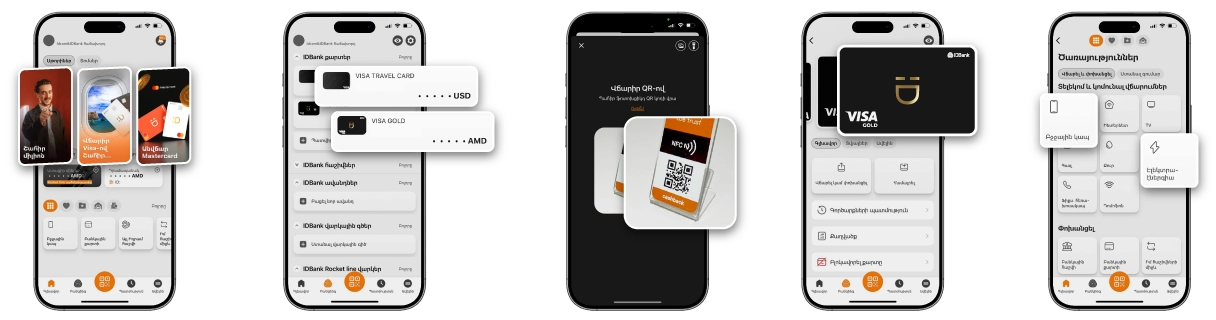

Package “IDBusiness Shoppy”

Overdraft - Up to AMD 50 mln

֏ bank account - Free of charge

Connection to IDBusiness system - Free of charge

Business mortgage

ID-EIB-III Project

Energy loan

The loan product is available in AMD and USD

Starting as low as 8.5%

Maximum 180 months

Low interest rate - Starting as low as 8%

Maximum 90 months

Up to 500 000 000 ֏

Further saving - Saving due to energy-efficient system

Starting as low as 8.5%

Low Commission fee - Starting as low as 0.5%

Customer

RA resident/RA non-resident Legal entity or Individual entrepreneurPurpose

Products provided within the package

1) Visa Business or Visa Platinum Business payment card,

2) Bank account denominated in AMD,

3) Remote banking systems: IDBusiness mobile and/or Bank-client system,

4) Overdraft provided to the card account.

2) Bank account denominated in AMD,

3) Remote banking systems: IDBusiness mobile and/or Bank-client system,

4) Overdraft provided to the card account.

One-time tariff for joining the package

1) For Visa Business payment card: one-time in the amount of 10,000 AMD,

2) For Visa Platinum Business payment card: free of charge.

2) For Visa Platinum Business payment card: free of charge.

Package Service Fee

1) For Visa Business payment card: 10,000 AMD per year,

2) For Visa Platinum Business payment card: AMD 30,000 per year.

2) For Visa Platinum Business payment card: AMD 30,000 per year.

Terms of issuance and maintenance of payment card provided within the package

1) Free of charge during the entire validity period of the payment card,

2) Urgent issuance of a payment card is carried out free of charge within 1 banking day

3) Provision of an additional card account statement at the Bank's premises or by e-mail free of charge

4) The other payment card service conditions, which are not mentioned in this information summary, are defined according to the information summaries of Visa Business and Visa Platinum Business cards.

2) Urgent issuance of a payment card is carried out free of charge within 1 banking day

3) Provision of an additional card account statement at the Bank's premises or by e-mail free of charge

4) The other payment card service conditions, which are not mentioned in this information summary, are defined according to the information summaries of Visa Business and Visa Platinum Business cards.

Terms of opening and maintenance of bank account within the package

1) Opening a bank account: free of charge

2) Provision of an additional bank account statement at the Bank's premises or by e-mail free of charge

3) The other bank account service conditions, which are not mentioned in this information summary, are defined according to the information summaries of the maintenance of bank accounts.

2) Provision of an additional bank account statement at the Bank's premises or by e-mail free of charge

3) The other bank account service conditions, which are not mentioned in this information summary, are defined according to the information summaries of the maintenance of bank accounts.

Terms of provision and maintenance of overdraft within the package

Defined according to the information summary of IDBusiness shoppy overdraft provision terms and conditions.

Information regarding credit history and credit score

You can learn about the importance of credit history and credit score here․

Details via abcfinance.am and acra.am links.

Details via abcfinance.am and acra.am links.

Apply now

Overdraft up to 50 mln ֏

Free Visa Business / Visa Platinum Business cards

Information bulletin

Information bulletin