General

Advantages

Customer

RA resident and RA non-resident legal entity or individual entrepreneur

Purpose

Overdraft provided through payment card for replenishment of working assets, current expenses and other business purposes

Currency

AMD, USD, Euro

Minimum amount

500,000 AMD or equivalent foreign currency

Maximum amount

50,000,000 AMD or equivalent foreign currency

Minimum term

6 months

Maximum term

36 months

Nominal annual interest rate

starting from 11%

Effective annual interest rate

11.6-20.6%

Overdraft service fee

not defined

Loan application review fee

not defined

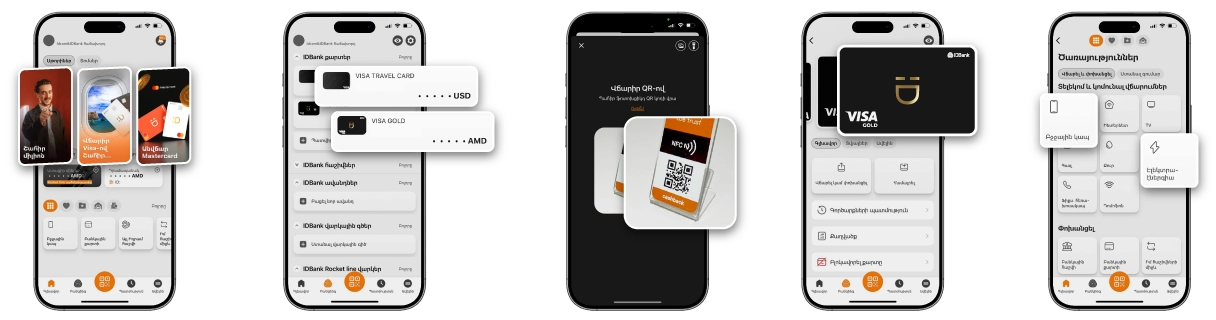

Method of providing overdraft

Non-cash, through a payment card opened in the Bank

Payment card type and service conditions

1) In the case of being provided within the scope of the “IDBusiness Shoppy” package, according to the provisions of the Information Summary of the “IDBusiness Shoppy” package provided to Corporate customers.

2) In case of being provided outside the scope of the “IDBusiness Shoppy” package, according to the conditions and tariffs set by the information summary of each card, posted at the following link: Information summary of Business cards

2) In case of being provided outside the scope of the “IDBusiness Shoppy” package, according to the conditions and tariffs set by the information summary of each card, posted at the following link: Information summary of Business cards

Repayments of overdraft amount and interest

Mandatory monthly entries to the card account on or before the 15th day of the given month, in the total amount of 10% of the overdraft used as of the last day of the previous month and the sum of accumulated interest, while repayment of the full amount of the overdraft at the maturity set by the overdraft agreement. Interest is repaid from the funds deposited on the card account in the amount of accumulated interest from each such entry.

Grace period

Up to 45 days

Interest may not be calculated against the non-cash overdraft amounts used during the previous month (except for card-to-card transfers, intrabank and interbank transfers within the RA and between own accounts) if the customer repays the used part of the overdraft in the specified manner before the 15th of the following month.

Interest may not be calculated against the non-cash overdraft amounts used during the previous month (except for card-to-card transfers, intrabank and interbank transfers within the RA and between own accounts) if the customer repays the used part of the overdraft in the specified manner before the 15th of the following month.

Minimum business activity term (uninterrupted)

6 months

Other requirements to the borrower

In case of borrowers with a status of a PE the age of the latter must not exceed 65 years by the overdraft repayment date.

Requirements to the borrower’s credit history

1. Absence of overdue/classified liabilities as of the date of overdraft extension,

2. Absence of more than 30 overdue days in the 12 months prior to the submission of the application

2. Absence of more than 30 overdue days in the 12 months prior to the submission of the application

Security

• Creditworthiness assessment, • real estate property,

• Fixed assets /equipment, technical appliances, other property/,

• Means of transportation,

• Commodities in circulation,

• Right to receivables,

• Financial flows (future cash flows),

• Guarantees, warranties,

• Funds,

• Precious metals (items),

• Shares,

• Securities,

• Pledge of rights,

• Other property of property rights not, prohibited by RA legislation

• Fixed assets /equipment, technical appliances, other property/,

• Means of transportation,

• Commodities in circulation,

• Right to receivables,

• Financial flows (future cash flows),

• Guarantees, warranties,

• Funds,

• Precious metals (items),

• Shares,

• Securities,

• Pledge of rights,

• Other property of property rights not, prohibited by RA legislation

Loan/Collateral (estimated liquid value of the collateral) ratio

According to the decision of the Bank’s competent body maximum 50-100% depending on the type of collateral (in case of loans secured by property collateral). According to the decision of the Bank’ competent body the loan can also be extended without security of property collateral or simultaneously with the security of property collateral and other security (guarantee, future cash flows, property right etc.).

Collateral insurance

according to the decision of the Bank’s competent body insurance of the collateral can be required from of the loan balance or the estimated market/liquid value of the property

Fines, penalties

penalty on overdue overdraft amount – 0.1 per day,

penalty on overdue interest amount – 0.1% per day,

no early repayment penalty is defined

penalty on overdue interest amount – 0.1% per day,

no early repayment penalty is defined

Location of application acceptance and overdraft processing

All branches of the Bank, the Bank’s website (regarding acceptance of application)

Positive factors of extension

1) good credit history,

2) positive creditworthiness estimation,

3) sufficient financial condition,

4) good reputation,

5) other factors.

2) positive creditworthiness estimation,

3) sufficient financial condition,

4) good reputation,

5) other factors.

Rejection factors

1) bad credit history,

2) negative creditworthiness estimation,

3) ՓԼ/ AML/CFT restrictions,

4) insufficient financial condition,

5) providing false or unreliable information,

6) providing such information that calls into question the return of the overdraft,

7) other factors.

2) negative creditworthiness estimation,

3) ՓԼ/ AML/CFT restrictions,

4) insufficient financial condition,

5) providing false or unreliable information,

6) providing such information that calls into question the return of the overdraft,

7) other factors.

Maximum decision-making term

3-5 business days after submitting the complete set of documents required by the bank

Term for notifying the client about the decision

1 business day

Decision validity term

30 business days

Re-approval of decision

maximum 2 times under the conditions of overdraft extension applied as of the date of reaffirmation

Overdraft extension term

Maximum 3 business days after submission of the package of complete documents required by the Bank and registration of the right of pledge after the decision on overdraft extension has been passed, unless the client wishes to receive the overdraft later while observing the term mentioned in paragraph 28

Information regarding credit history and credit score

You can learn about the importance of credit history and credit score here․

Details via abcfinance.am and acra.am links.

Details via abcfinance.am and acra.am links.

Apply now

Overdraft with ֏, $ and €

Simplified business analysis

Information bulletin

Information bulletin