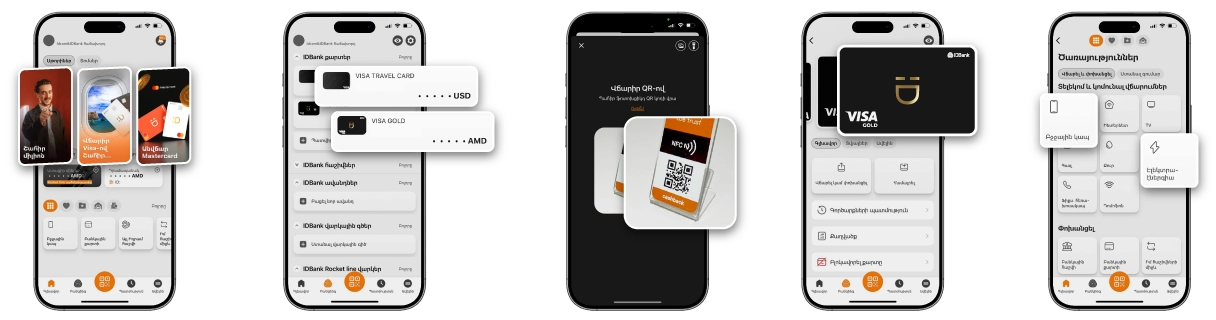

General

Advantages

Purpose

Business activities

Currency

AMD, USD

Security

residential, public, commercial real estate

Type of the interest rate

Fixed rate for the first 12 months and floating rate for 13 to 60 months

Annual interest rate (nominal) AMD

Stated income loans

Fixed interest rate 15.5% - 18.5%

Floating interest rate: IBRR + /6.2%-9.2%/

Fixed interest rate 15.5% - 18.5%

Floating interest rate: IBRR + /6.2%-9.2%/

Annual interest rate (nominal) AMD

Self-certified loans

Fixed interest rate 16% - 19%

Floating interest rate: IBRR + /6.7%-9.7%/

Fixed interest rate 16% - 19%

Floating interest rate: IBRR + /6.7%-9.7%/

Annual interest rate (nominal) USD

Stated income loans

Fixed interest rate 11%-13%

Floating interest rate: IBRR + /7.1% - 9.1%/

Fixed interest rate 11%-13%

Floating interest rate: IBRR + /7.1% - 9.1%/

Annual interest rate (nominal) USD

Self-certified loans

Fixed interest rate 12․5% - 14․5%

Floating interest rate: IBRR + /8.6% - 10.6%/

Fixed interest rate 12․5% - 14․5%

Floating interest rate: IBRR + /8.6% - 10.6%/

Minimum term

24 months

Maximum term

60 months

Minimum amount

5,000,001 AMD or equal USD

Maximum amount

125,000,000 AMD or equal USD

Maximum loan/collateral ratio (to the estimated residual value of the property)

40- 70%

Type of credit line

- Credit line with recoverable limit

- Credit line with unrecoverable limit

- Credit line with repayment schedule

- Credit line with unrecoverable limit

- Credit line with repayment schedule

Method of disbursement

Cashless: through the current account.

Status

RA resident legal entity, RA resident individual entrepreneur

Age restrictions

IE persons must be at least 21 years old, whose age must not exceed 65 years by the loan maturity

Requirements to the credit history

-no existing overdue/ classified obligations (loan, credit line, overdraft, guarantees, etc.). -no credit history. - The customer should not be included in the list of unwanted customers of the Bank.

OTI ratio (total debt (average monthly) to net income ratio)

AMD- up to 60%, USD- up to 55%

Collateral

Residential /public/ commercial real estate located on the territory of the Republic of Armenia, including a separate land plot – settlements of designated purpose located in Yerevan,

Pledger

Any individual or legal entity (in the case where the pledgor is a legal entity, it should have state registration in RA)

Appraisal of a subject of collateral

The subject of collateral must be appraised by specialized organizations partners of the Bank, the list of which is available by the following link: List of appraisal companies

Minimum requirements to the subject of collateral

1. The real estate should have masonry, panel or reinforced structure (except for the dividing walls and covers between the floors). 2. The real estate should not be public housing, or located on the territory occupied by other constructions – dormitory. 3. The real estate must not be located on the territory of exclusive public interest. 4. If the subject of pledge is a detached house, it must not have a common yard area, common or joint ownership with other property.

Insurance of the borrower against death and permanent disability resulting from accidents

May be required by the Bank

Insurance of the subject of pledge

May be required by the Bank

Loan application processing fee

Not specified

One-off loan disbursement fee (charged from the contractual loan amount at the moment of the loan disbursement)

NE

Monthly loan service fee calculated for the loan balance

Calculated on the loan balance: 0.1%

To the overdue loan, daily

0.10%

To overdue interest, daily

0.10%

Early repayment fee

In the amount of 5% of the early repaid loan amount

Master loan agreement

The bank can conclude a Master Loan agreement with the client for a period of up to 240 months

Positive factors based on which the loan may be extended

1) Good credit history, 2) Stable cash flows, 3) compliance of the subject of collateral with the requirements of the Bank 4) Other factors

Negative factors for the loan decision-making

1) negative credit history, 2) Incompliance of the collateral with the requirements of the Bank 3) provision of false or unreliable information, 4) provision of such information, which rise suspicion to the return of the loan, 5) negative credit history of the person affiliated with the client, if the Bank considers that the client's income can be used to fulfill the obligations of the affiliated person or the income of the affiliated person can be used to fulfill the obligations of the client

Maximum term of taking decision

Maximum 2-5 business days after submitting all required documents to the Bank

Maximum terms for giving notice to the customer

1 business day

Maximum validity period

30 business days.Within three months after the expiration date of the approved loan decision, the loan decision can be reaffirmed without submitting an additional application, unless the credit history and income of the borrower (co-borrower) and family members have not changed significantly.If necessary, the Bank may require to update the documents substantiating the income.

Term of credit line disbursement

1 business day after submitting document, which confirms the right with regard to the collateral

Place of acceptance, registration and providing the credit line application

All branches of the Bank

Information regarding credit history and credit score

You can learn about the importance of credit history and credit score here․

Details via abcfinance.am and acra.am links.

Details via abcfinance.am and acra.am links.

Apply now

Repayment Term up to 60 months

No Income Justification for credit lines up to 25 mln ֏

Information bulletin

Information bulletin