General

Advantages

Why you should cooperate with IDBank?

The joint digital platform of IDBank and Idram has more than 500,000 users who will see the offer on the Internet and mobile banking advertising platforms and become potential customers of your business.

Rocket Line 0% is a digital loan that enables your business to boost sales volumes.

Rocket Line 0% gives the customer the opportunity to receive the product or service at the very moment and pay the same amount for the product later.

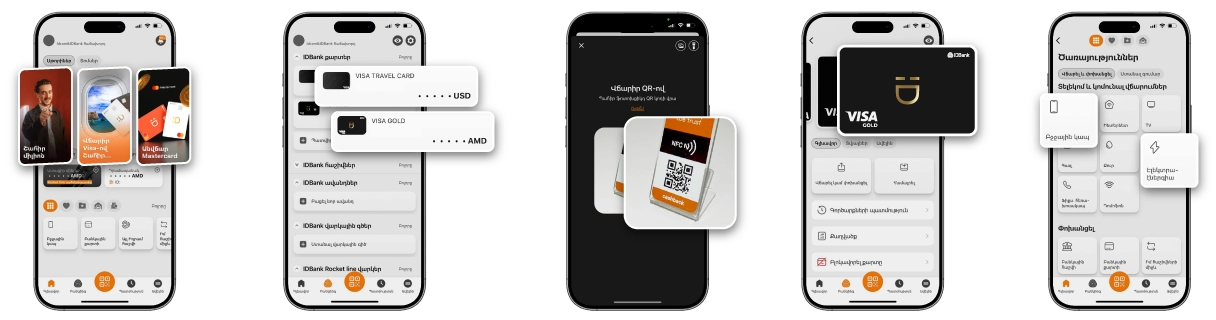

When shopping at a trading point, the customer simply scans the QR code using the Idram&IDBank application, and when shopping on the website, he chooses Idram as a payment option. If the trading point cooperates with the Bank within the framework of Rocket line 0%, then in addition to the "Pay now" option, the client is also offered to pay the same amount in 1 month, 2 months, 3 months and 6 months, depending on the terms of cooperation of the trading point and the Bank.

Forming and servicing a classic credit will require additional resources from your company, and after the credit is issued, it takes a considerable amount of time before the money is deposited to your account. While, in the case of Rocket line 0% digital loan, the amount is deposited into your account immediately after payment, without wasting time.

Rocket Line 0% provides an increase in sales volume. When a customer delays a purchase, the likelihood of ever making the purchase decreases. And with the Rocket Line limit, the buyer can afford to make the purchase at the very moment without procrastinating it, because even after 1, 2, 3 or 6 months he/she will pay the same amount as now.

The customer does not fill out applications, does not sign paper contracts and other documents, so there is no need for an employee to formulate a loan at the trading point, conduct and maintain documents. The entire process of formulating a loan is carried out by the customer with his/her smartphone in a matter of seconds, and the business saves time and resources.

Simply fill in the contact person's details using the following link. After receiving the application, the individual manager will contact you, answer all your questions and process the application. Or simply visit any branch of the Bank and fill out the application form.

In the case of repayment of the loan with the annuity option, the customer/buyer makes equal repayments in accordance with the repayment schedule provided. Loans with terms of up to 6 months, inclusive, are repaid at the end of the period and in the case of loans with a term of 9 to 36 months, in the form of annuity repayment.

Digital installment loan on the spot via the Idram&IDBank application

Saving resources

Potential for sales volume growth