General

Advantages

Business class Visa international payment cards for only AMD 10,000 per year.

Special offer

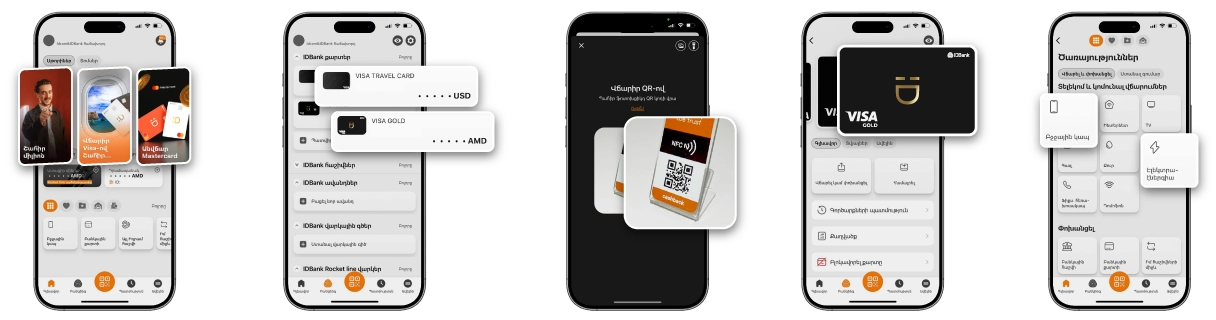

Make all transfers and payments, manage accounts with IDBusiness mobile application. Track transaction history with 24/7 access from anywhere. Connection of IDBusiness and IDBanking system - application download and activation is free of charge.

Card currency

AMD, USD, EUR, RUB

Card issuance within 2-5 banking days

Free of charge

Card validity period

5 years

Urgent card issuance within one banking day

AMD 5,000

Card account opening

Free of charge

Annual card account service fee

AMD 10,000

On-decreasing balance on card account

Not defined

Interest rate calculated on the positive balance of the card account

Annual simple interest rate: 0%

Annual percentage yield: 0%

Annual percentage yield: 0%

Provision of an additional card

Free of charge

Annual service fee for the additional card

AMD 2,000

Card blocking

Free of charge

Card unblocking

Free of charge

Card re-issuance for cards with expired validity period

Free of charge

Recovery of PIN code

Free of charge

Provision of a card duplicate in case of damaged, unusable, lost/stolen card or PIN code (with the same card validity period)

AMD 5,000

Import of card in international STOP list (for 7 days in one region)

AMD 10,000

Export of card from international STOP list

Free of charge

Provision of card account statement

Activation of SMS notification service

Free of charge

Fee per SMS notification

AMD 15

Card account replenishment (Depositing cash funds into the account)

Closing card account and card return

Free of chargeDaily cash withdrawal limit

Daily number of cash transactions

10

Review of daily withdrawal limit and/or daily number of transactions for unlimited period of time

1,000 AMD

Card and PIN delivery fee

5000 AMD for each envelope to be sent

Cash withdrawal from Bank’s ATMs and cash points

AMD – 0.2%

Foreign currency – 0.5%

Foreign currency – 0.5%

Commission for cash withdrawal from the Bank's cash points (POS terminal) and from a card account without the use of a card (Cash disbursement/withdrawal from the account)

Cash withdrawal from ATMs and cash points of other banks of ArCa system

1%

Cash withdrawal from ATMs and cash points of non-member banks of ArCa system and foreign banks

1.5%, minimum AMD 1,500

Commission for transfers from the Bank's card to the cards of banks that are members of ArCa system, through ATMs, www.arca.am website

0.5%

Non-cash card payments at trade/service points, including online/virtual environment

Free of charge

Tariff archive

The amount of daily cash withdrawal is 5 million AMD, 10,000 USD/Euro, 600,000 RUB, but based on the Client’s application, the mentioned amounts can be changed/increased.

The annual fee is 5,000 (five thousand) AMD; upon the consent of the competent body of the Bank, the annual service fee of the card for the first year may not be charged.

Visa Business card is issued to resident and non-resident legal entities and individual entrepreneurs.

You can find out the details on the Bank’s website, and in case of questions you need to visit any branch of the Bank or call the Bank's call center at (+37410) 593333, (+37460) 273333.

Visa Business cards are issued for a period of 5 years.

Visa Business cards are issued in the following currencies: AMD, USD, EUR, RUB.

Fees for cash withdrawal from the Bank’s ATMs and cash withdrawal points, banks members and non-members of ArCa system, and ATMs and cash withdrawal points abroad, as well as card-to-card transfer fees can be found here.

In case of loss of the card, the customer must as soon as possible, by phone or in any other possible way inform:

✓ “Armenian Card” CJSC processing center by calling (+37410) 59 22 22, which is available 24 hours

✓ the Bank Call Center at (+37410) 59 33 33, which is available 24 hours, or

✓ Visit any branch of the Bank with an identity document

Once the customer gives notice on the lost card by phone, the card transactions will be immediately suspended.

✓ “Armenian Card” CJSC processing center by calling (+37410) 59 22 22, which is available 24 hours

✓ the Bank Call Center at (+37410) 59 33 33, which is available 24 hours, or

✓ Visit any branch of the Bank with an identity document

Once the customer gives notice on the lost card by phone, the card transactions will be immediately suspended.

Order now

All business payments with a single card

The card is available worldwide

Information Bulletin

Information Bulletin