Chairman of the Management Board of IDBank: We don’t foresee significant risks of the Armenian banking system in 2019.

What risks can Armenian banks meet in 2019? What is the forecast for the banking system growth rate? What is going to happen to the refinancing rate? Will the current year become a year of serious changes for IDBank? Chairman of the Management Board of IDBank talks about these and other questions in his exclusive interview with “ARKA” agency.

ARKA: Mr. Abrahamyan, you have been leading IDBank since January. In what state did you receive the Bank? What were the annual indicators for the end of 2018?

M. Abrahamyan: The Bank has gone through different stages of development during the 28 years. There were both success and challenges, which is natural. But, according to recent trends for the past two years the indicators have significantly improved. Overall, the indicators are stable for 2018 as compared to 2017. Past year was a year of stability for the Bank, essential problems were solved and prerequisites for further development and growth were created. The Bank closed 2018 with profit, the assets and capital remaining almost on the same level. I would mention the 10% growth of lending among positive trends. Yet, there is still much to be done. According to our forecast the indicators for 2019 will improve significantly.

ARKA: What are your expectation from 2019, will it be a year of serious changes for the Bank, which is natural in the context of a new manager and ambitious strategic issues?

M. Abrahamyan: There are positive basis for that in 2019, there is optimism. It will take big efforts and work, since the competition in the banking system is sharp, nevertheless, on the other hand, a political stability has been established in the country, thus, overall our expectations are positive. We think that the current year is going to be more success than the previous one.

ARKA: In 2019 the international rating agency Fitch expects decrease in the Armenian banking system growth rate. What is your forecast in this regards? What are the risks the Armenian banking system can meet in 2019?

M. Abrahamyan: I am not familiar with the Fitch estimates, but according to our forecasts our bank’s indicators are going to be better in 2019 as compared to 2018 in the view of past year development. We do not see any serious risks for 2019. From the point of view of internal developments, the expectations are overall positive. There are always the external risks: if you look at world economy development the tendencies are, in general, controversial. The forecasts for the US economy are more positive than for Europe and Russia. Nevertheless, I do not see any serious risks for 2019, but, even if there are essential shocks, we will be able to resist them taking into account the stability of the Armenian banking system.

ARKA. The IMF and the Fitch recommend that the Central Bank of Armenia increases the capital normatives or set additional capital contributions for the Armenian banks. Do you justify these recommendations? Does the Armenian banking system need additional capital? How are things going with IDBank capitalization?

M. Abrahamyan: Here we are talking about capital adequacy and application of additional buffers thereto, which is a Basel III component. We have already introduced part of Basel III two years ago, still need to introduce the second part which refers to additional buffers. The introduction of Basel III was initiated after the 2009 crisis to increase the stability of banks and absorb potential risks in terms of capital. The Central Bank of Armenia will most probably introduce additional buffers in the months to come. But this process will be gradual and will be implemented in 4-5 years, which will not have a significant impact on the banking business. The long-term goal is the establishment of a more stable banking system from the point of view of resistance to risks and shocks.

It will give extra confidence, including to customers, and it is very important for future financing of economy. It’s about three types of buffers: capital conservation buffer, countercyclical capital buffer as well as a buffer for banks of system importance. In terms of this indicator IDBank is at quite high positions. If in terms of assets the bank is in the 7th position in the Armenian banking system, in terms of capital adequacy it occupies the 3rd position. It gives us confidence that we will be able to develop and grow rapidly in the future.

ARKA: Starting from the beginning of 2017 the CBA stopped the weakening of the monetary policy setting the refinancing rate at 6% which is preserved up to now. How, according to you, does this level of refinancing rate promote growth of investments in the real sector of the economy, and what changes in terms of the rate can be expected in the first half of the year and by the end of the year, and what it can be related to?

M. Abrahamyan: The main goal of the CBA is to ensure stability of prices, and that is what the refinancing rate is used for a main tool of the CBA policy. This policy is based upon very serious analyses, forecasts and scenarios. Based on the fact that we closed the year with low inflation, I think no significant changes will happen in the first half of the year, and depending on the economic activity, they are possibly to happen in the second half of the year. However, according to our forecasts, the rate will not change significantly.

ARKA: In June 2018 the Banks started the process of concession of fines and penalties of loans to physical entities. Restructuring of loans to military servicemen is not excluded. How do these processes impact the activities of banks and IDBank in particular?

M. Abrahamyan: First, let me mention that it is an important decision since the banks have always been more interested in negotiating with customers and finding compromise solutions. In fact, banks often use those opportunities. However, why is this decision important? In the past in case of compromises and concessions a bank was not only deprived of its income but also fulfilled tax liabilities. This decision lightened that burden and in the future banks will be more prone to such changes. Recently we have been discussing the impact of that decision on our bank. IDBank has made reconciliation agreements with around 1200 customers. As a result of this fines and penalties in the amount of around 850 million AMD have been concessed. Overall, I estimate the activities of this half year as quite positive, and we have already announced about the extension of the concession process so that those customers, who, for some reason, haven’t had a chance or couldn’t apply for concession of fines and penalties, have the opportunity to do so.

ARKA: How much is the share of the Bank’s nonperforming assets in the overall amount of such assets in the banking system? What measures does the Bank plan to take this year to improve the quality of assets?

M. Abrahamyan: In general, the nonperforming assets ratio in the banking system of Armenia is rather low. It is first conditioned by the fact that the regulator has strict requirements set. Historically it happened so that there are good infrastructures in Armenia to mitigate risks, particularly the Credit Bureau. The mentioned indicator is also low due to cautious policy of the Banks as compared to other countries. If I am not mistaken, the indicator of nonperforming assets in the banking system is 7%. In this regard we are in a more favorable condition. In the past, of course, there were big problematic assets. Now we are in the process of cleaning and have decided to start from a new page and go ahead. If we consider the loan portfolio of the several past years, it can be estimated as healthy.

ARKA: Armenian banks make substantial allocations of reserves in case of possible loan losses (such expenses making around 50% of profit of the banking sector). What is it related to and how does it impact the price of loan products?

M. Abrahamyan: Banks make allocations of reserves in case of credit risks, particularly, overdue loans when the borrower is unable to fulfil his/her obligations. In fact, those allocations reduce the tax base since it is unearned income and that is why it is not subject to taxation. Loan interest rate includes several components, including the credit risk. And the higher the risks the more expensive loans are. Naturally, effective management implies credit risk reduction.

ARKA: How do you overall estimate the market competition? How does IDBank act in that field? What is the focus of the Bank in attracting new customers?

M. Abrahamyan: The competition in the banking market is very sharp. It is one of the most competitive spheres in the economy of Armenia. Banks are fighting for every customer. Naturally, there are positive aspects: improvement of services, introduction of new solutions, application of creative approaches.

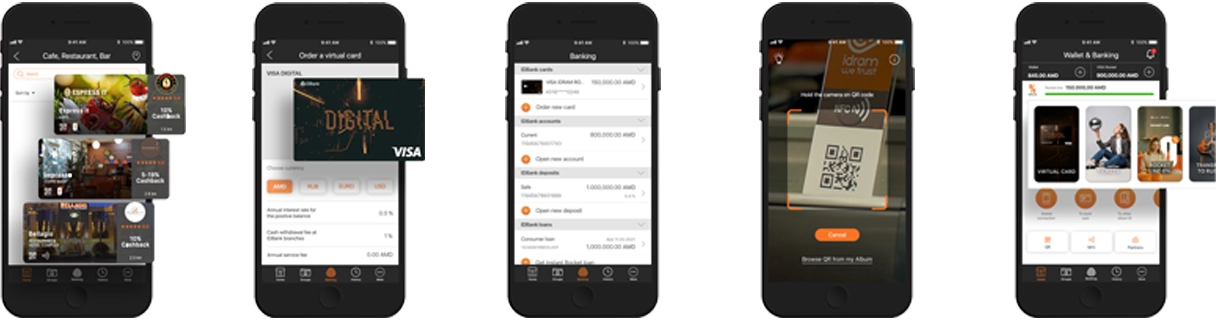

From that perspective we welcome the competition and are ready to it. We place special importance both to the quality of services rendered and introduction of new services so that our customers stay satisfied. IDBank has chosen the strategy of digital banking. We will try to serve our customers fast, render simple and accessible services and compete in the banking system in this given context. The Bank has made serious investments in the sphere of new technologies and we are ready to competition is this regard.

ARKA: The Bank has implemented total rebranding at the end of May, 2018 and announced about strengthening of digitalization and innovative approaches. What innovations does IDBank apply and what is it planning to introduce in the future?

M. Abrahamyan: We have been busy preparing to changes in the past two years. This year we will have an important launch of updated Internet Banking, the new mobile banking application will be introduced, which, according to us, will be very convenient and multifunctional. There are a number of projects in the context of which very few banks in the market will be able to compete with us in term of technology.

ARKA: What is the customer involvement in digital products today, particularly, in mobile banking? How can digitalization contribute to the growth and popularization of banking products?

M. Abrahamyan: It is inevitable future. Of course, there are customers who are used to traditional banking and their preferences can not always be changed. However, there is a big team of customers, especially young, who prefer digital products. It is also associated with lack of time. Keeping our focus on our target group of strategic importance, i.e. people who prefer technological progress, in the meantime we are ready to serve all of our customers.

Regarding customer attraction, overall, digitalization in Armenia is on a low level, however the growth rates are encouraging. The annual growth of people using digital products in the world is 50-60%. In that context, too, we want to hold a beading position.