General

Advantages

Compare products

Rocket loans/credit lines

The loan is being approved within a few minutes

You apply online to get the limit without visiting the bank and without paperwork

The loan is provided without any commissions

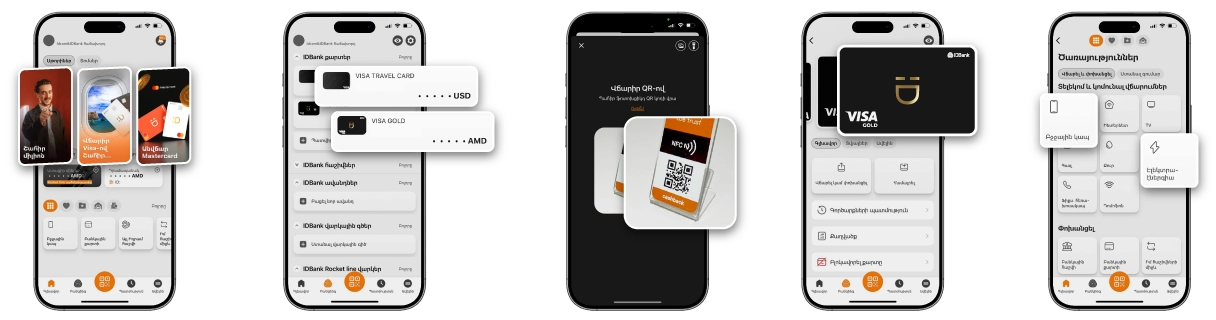

Rocket Line

Credit Lines

Get or increase your limit without visiting the bank

There is no need to submit any documents or conclude an agreement

The loan is provided without any commissions

Use the amount free of interest up to the 15th day of the following month.

Maximum loan amount is 10 000 000 AMD

Interest rate is lower than for the other credit lines - 15-16 % only

The loan is provided without any commissions

Special offer

Enjoy Rocket Line digital loan of up to 10 million AMD through Idram&IDBank app or IDBanking.am platform. Get now, pay over 60 months. Moreover, you can use Rocket Line 0% when making payment with hundreds of partners, without any interest rate or additional payment. with an actual interest rate of 0% and without additional fees.

Type of loan

Loan/credit line

Purpose

Consumption

Currency

AMD

Minimum loan amount/limit

AMD 100,000

Maximum loan amount/limit

AMD 10 000 000

Annual nominal interest rate

AMD-19.9%-21.7%

AMD 19%-21%

AMD 19%-21%

Effective annual interest rate

AMD-21.82% -23.99%

AMD- 20.89%-23.34%

AMD- 20.89%-23.34%

Minimum loan maturity

12 months/18 months

Maximum loan maturity

60 months/36 months

Method of disbursement

Non-cash through current account/ Noncash through payment card

Loan and interest repayment method

Fixed monthly payments (Annuity)

Security

1) Credibility score, 2) Cash flows 3) Guarantee of a physical person, upon necessity,

Loan application review fee

Not specified

Loan disbursement lump sum fee

Not specified

Loan account service fee

Not specified

Opening of current account and loan withdrawal fee

Free of charge

Tariffs for payment cards/credit line

1. Idram Rocket Visa – а co-branded card based on the current tariffs available through the following link: Idram Rocket VISA Information bulletin

2. Visa Digital – a digital payment card based on the current tariffs available through the link: Visa Digital Information Bulletin

3. Travel Card payment card based on the current tariffs available through the link: Travel Card Information bulletin

2. Visa Digital – a digital payment card based on the current tariffs available through the link: Visa Digital Information Bulletin

3. Travel Card payment card based on the current tariffs available through the link: Travel Card Information bulletin

Status

RA citizen physical person

Age eligibility

The borrower/guarantor should be 21 at least as of the date of application, and maximum 65 by the maturity date

Requirements to the credit history of the borrower/guarantor

1. The customer must have a good credit history, or 2. in case the customer has no credit history, he/she must be a registered employee for at least 6*month period preceding the date of the loan provision 3. The customer should not be included in the list of unwanted customers of the Bank.

Overdue loans, per day

0.1%

Overdue interest, per day

0.1%

Early repayment fee

Not specified

Grounds, on which the Bank may require early repayment of the loan

The Bank may require early repayment of the loan, if: 1) the customer withholds from the payment card, 2) information presented to get the loan is false or inaccurate, 3) obligations provided by the agreement failed to be performed, 4) other grounds, according to the agreement

Positive factors for provision of the loan

1) Good credit history, 2) Good Score, 3) Enough cash flow

Loan rejection factors

1. Non-compliance with the conditions of the loan type

2. Adverse credit history of the client

3. Adverse credit history of the person affiliated with the client

4. Insufficient income

5. Insufficient level of creditworthiness

6. Insufficient level of collateral liquidity from the bank's perspective

7. An undesirable client for the bank

8. Provision of false or unreliable information

9. Availability of information casting doubt on loan repayment

10. Lack of a client email address

11. Other reasons

2. Adverse credit history of the client

3. Adverse credit history of the person affiliated with the client

4. Insufficient income

5. Insufficient level of creditworthiness

6. Insufficient level of collateral liquidity from the bank's perspective

7. An undesirable client for the bank

8. Provision of false or unreliable information

9. Availability of information casting doubt on loan repayment

10. Lack of a client email address

11. Other reasons

Maximum decision-making period

Up to 5 minutes when applying online/Up to 1 business day when applying at the Bank branch

Notification of the client about the decision

Up to 5 minutes when applying online/Up to 1 business day when applying at a Bank branch. The customer may be notified either within the territory of the Bank, by phone call or through e-mail

Validity term of decision

Maximum 5 minutes when applying online / Up to 5 business days when applying at the Bank branch

Maximum 5 minutes when applying online /Up to 15 business days when applying at the Bank branch

Maximum 5 minutes when applying online /Up to 15 business days when applying at the Bank branch

Information regarding credit history and credit score

You can learn about the importance of credit history and credit score here․

Details via abcfinance.am and acra.am links.

Details via abcfinance.am and acra.am links.

Apply now

0% commission

Scan the QR

Apply online with one click through the Idram&IDBank app

Apply online with one click through the Idram&IDBank app

Apply online with one click through the Idram&IDBank app

Apply online with one click through the Idram&IDBank app

Information bulletin Rocket loans/credit lines

Information bulletin Rocket loans/credit lines