General

Advantages

Get a loan or credit line up to the amount of your deposit/bond

Compare products

Loans secured by cash collateral and bonds

Starting from 2.28 %

The maximum loan amount is 250,000,000 AMD

Use the money free of interest until the 15th of the following month

Consumer loan

Up to 5% of the loan, not more than 5,000,000 AMD

The borrower chooses the repayment option convenient for him

The loan is provided without up- front fee

The maximum loan amount is 125,000,000 AMD

Special offer

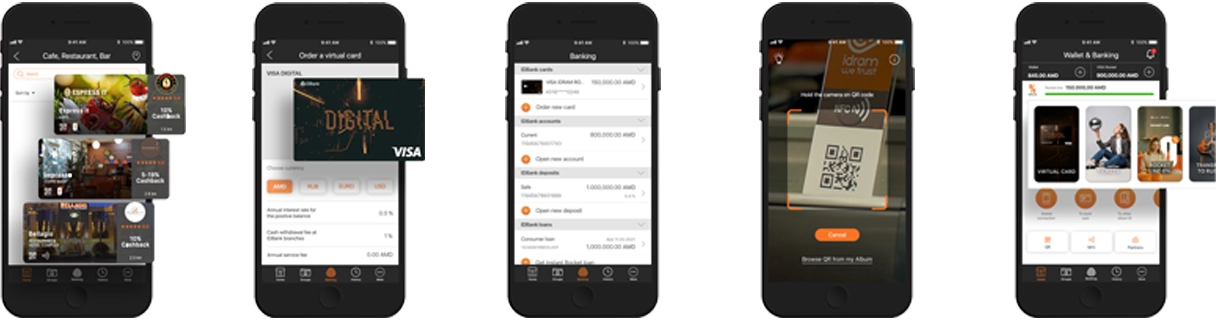

Rocket Line and Rocket Line 0%

Enjoy Rocket Line digital loan of up to 10 million AMD through Idram&IDBank app or IDBanking.am platform. Get now, pay over 60 months. Moreover, you can use Rocket Line 0% when making payment with hundreds of partners, with an actual interest rate of 0% and without additional fees.

Loan type

Loan / Credit line

Purpose

Other

Currency

AMD

Maximum amount

AMD 250 000 000

Annual nominal interest rate

Single-currency loan-Interest paid on the deposit and/or the annual coupon rate of the bond + 2%

Multicurrency loan-Refinancing interest rate of the Central Bank of Armenia + 5%

Multicurrency loan-Refinancing interest rate of the Central Bank of Armenia + 5%

Annual effective interest rate

Single-currency loan: 2.28%-11.60%/2.63%-18.57%

Multicurrency loan: 16.08%/16.57%-23.38%

Multicurrency loan: 16.08%/16.57%-23.38%

Annual interest rate accrued on the unused part of the credit line

Credit Line: 0%

Maximum term

Before the maturity date of the bond and/or deposit

Minimum term

2 month

Minimum amount

AMD 100,000

Repayment method

Loan: 1. Annuity – equal monthly payments,

2. discount – repayment of interest at the beginning of the term, and repayment of the principal amount at the end of the term

3. Spiral – equal monthly repayment of the principal amount, and monthly payments of interest,

4) preferential - interest payments are paid monthly, and the principal amount is paid at the end of the term.

Credit line:

1. Repayment of interest before the 15th day of each month in the aggregate amount of interest accrued as of the 1st day of the same month.

2. Repayment of principal amount at the end of term.

2. discount – repayment of interest at the beginning of the term, and repayment of the principal amount at the end of the term

3. Spiral – equal monthly repayment of the principal amount, and monthly payments of interest,

4) preferential - interest payments are paid monthly, and the principal amount is paid at the end of the term.

Credit line:

1. Repayment of interest before the 15th day of each month in the aggregate amount of interest accrued as of the 1st day of the same month.

2. Repayment of principal amount at the end of term.

Grace period for credit line repayment

Credit Line: Up to 45 days, no interest is calculated towards non-cash amount used from the credit line during the previous month (except for card to card transfers, intrabank and interbank transfers on the RA territory and transfers between own accounts) if the client makes repayment of the used parts of the credit line before the 15th day of the current month

Minimum/maximum amount of monthly repayment of credit line

Not defined

Maximum loan/collateral ratio

Single-currency loan -95%

Multicurrency loan - 90% of the nominal amount of the pledged funds or bonds bonds in USD and EUR

70% of the nominal amount of the pledged funds or bonds in RUR

Multicurrency loan - 90% of the nominal amount of the pledged funds or bonds bonds in USD and EUR

70% of the nominal amount of the pledged funds or bonds in RUR

Disbursement method

non-cash through a current account

Credit Line: non-cash through a payment card

Credit Line: non-cash through a payment card

Security

funds invested in the Bank by the client or another person (individual, legal entity or individual entrepreneur), and/or the right of claim to funds and/or purchased bonds issued by “IDBank” CJSC

Extension of loan/credit line term

The term of the loan/credit line may be extended on the basis of an application submitted by the Client at least one business day before the end of the loan/credit line, in accordance with the conditions in force at the Bank on the date of extension, if:

1) in case of loans up to AMD 20 million the borrower should not have a delay of more than 3 (three) business days for classified or overdue loan liabilities at ID Bank as of the date of acceptance of the loan application.

2) In case of loans exceeding AMD 20 million

3) The borrower should not have a delay of more than 3 (three) business days for classified or overdue loan liabilities in the financial banking system of the Republic of Armenia as of the date of acceptance of the loan application.

The term of the loan/credit line can be extended maximum until the maturity date of the deposit and/or the bond.

1) in case of loans up to AMD 20 million the borrower should not have a delay of more than 3 (three) business days for classified or overdue loan liabilities at ID Bank as of the date of acceptance of the loan application.

2) In case of loans exceeding AMD 20 million

3) The borrower should not have a delay of more than 3 (three) business days for classified or overdue loan liabilities in the financial banking system of the Republic of Armenia as of the date of acceptance of the loan application.

The term of the loan/credit line can be extended maximum until the maturity date of the deposit and/or the bond.

Status

RA resident/RA non-resident physical entity

Age restriction

The borrower’s age must not be below 18 as of the date if acceptance of the loan application.

Requirement to the credit history (good credit history)

For loans up to AMD 20 million: The borrower should not have a delay of more than 3 (three) business days for classified or overdue loan liabilities at ID Bank as of the date of acceptance of the loan application. For loans exceeding AMD 20 million: The borrower should not have a delay of more than 3 (three) business days for classified or overdue loan liabilities in the financial and banking system of the Republic of Armenia as of the date of acceptance of the loan application.

Daily fine, penalty for overdue loan

0.1%

Daily fine, penalty for overdue interest amount

0.1%

Early loan repayment fine

Not defined

Grounds for requesting early repayment of the loan

The Bank’s competent body can request early repayment of the loan, if: - The information provided for receiving a loan are false or unreliable, - The client has a classification other than “standard” in terms of loan obligations in the RA financial-banking system, - The client refuses the payment card, - Other grounds according to the agreement.

Type of card

Payment cards of any type issued by the Bank, except for debit cards

Payment card tariffs

In accordance with the tariffs set by the Bank for specific payment cards available through the following link: Information bulletin of payment cards

Loan/credit line disbursement commission fee

Not defined

Rejection factors

1) bad credit history, 2) provision of false or unreliable information, 3) provision of such information which disputes the return of the credit line, 4) absence of email address of the client, 5) other factors

Extension factors

1) compliance of the borrower’s information with these lending conditions, 2) good credit history

Maximum term for making decision on loan/credit line disbursement

maximum 2 business days after submission of the required documents to the Bank

Term for notification about the decision

1 business day after the decision is made. The Bank can notify the client about the decision made on provision of the loan at the premises of the Bank, by a phone call or e-mail.

Loan/credit line disbursement term

1 business day after submission of the loan application except for card loans the term for which is 3 business days

Maximum decision validity term

15 business days

Place of accepting and processing loan/credit lineapplications

all branches of the Bank

Information regarding credit history and credit score

You can learn about the importance of credit history and credit score here․

Details via abcfinance.am and acra.am links.

Details via abcfinance.am and acra.am links.

Apply now

Low interest rate, starting from only 2.28%

Information bulletin

Information bulletin