General

The advantages of your card

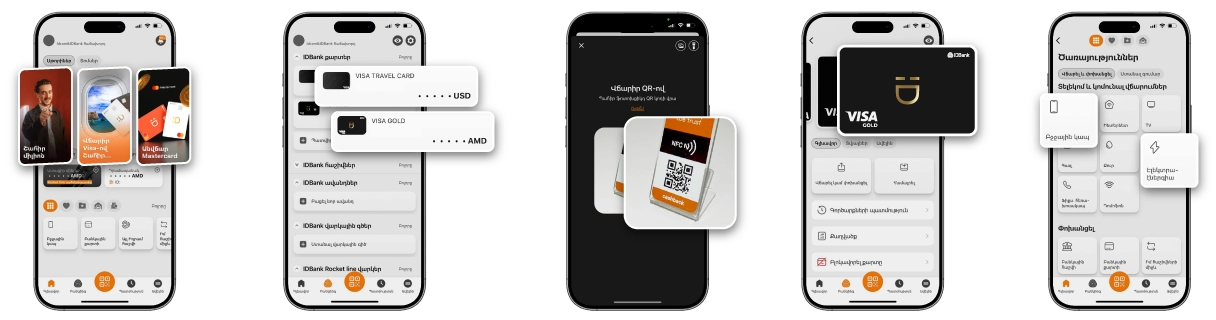

Compare products

Transfer

The card is provided and serviced free of charge

Cash withdrawal from IDBank ATMs points is free

The money is transferred to the card without visiting the bank by phone

Order the card by simply filling out the online application

Caring card

Special offer

Rocket Line and Rocket Line 0%

Enjoy Rocket Line digital loan of up to 10 million AMD through Idram&IDBank app or IDBanking.am platform. Get now, pay over 60 months. Moreover, you can use Rocket Line 0% when making payment with hundreds of partners, with an actual interest rate of 0%.

Card currency

AMD, EUR, USD, RUR

Card issuance within 2-5 business days

Free

Validity term

2 years

Opening of card account

Free

Annual card account service fee

Free

Re-issuance of expired card

Free

Card account minimum balance

Not specified

Issuance of duplicate card in case the card or PIN code is damaged, invalid or stolen for the same validity period

1,000 AMD

Provision of monthly statement from the card account at the Bank, through post2 or e-mail

Free

Provision of additional statement from the card account at the Bank, through post or e-mail

1,000 AMD

Card blocking

Free

Card unblocking

500 AMD

SMS service activation

Free

Fee for each SMS

AMD 15

Fee for each PUSH notification

Free of charge

Cash withdrawal fee (from the Bank’s ATMs and pos terminals with the use of cards)

According to the tariff defined by the Bank for the given day

Cash withdrawal fee from ATM-s of ArCa system’s other banks

1%

Fee for non-cash transactions

Free

Daily cash withdrawal limit for accounts denominated in AMD, the limit can be changed upon the customer’s request

AMD 500,000

Daily cash withdrawal limit for accounts denominated in USD, the limit can be changed upon the customer’s request

USD 1,000

Daily cash withdrawal limit for accounts denominated in EUR, the limit can be changed upon the customer’s request

EUR 1,000

Daily cash withdrawal limit for accounts denominated in RUB, the limit can be changed upon the customer’s request

RUB 50,000

Annual interest rate to be accrued on the balance of card account

Annual simple rate: 0%

Annual interest rate: 0%

Annual interest rate: 0%

Closing of the card account or card return

Free

Claiming accuracy of transaction

Free

Replenishment of card account

Designed for replenishment via fast money transfers

Through ATMs and through the ArCa application

0.5%

In case of transfers via IDBanking.am and Idram platforms from card accounts of the synchronized cardholders of the Bank to ArCa system members’ cards

0.5%

In case of transfers via IDBanking.am and Idram platforms from card accounts of the synchronized cardholders of the Bank to the cards of the Bank

Free

Commission for withdrawing cash from the Bank's ATMs

0% - in case of withdrawal of up to AMD 1,000,000 (foreign currency equivalent) within a calendar month,

1% - in case of withdrawal of funds in the amount of more than AMD 1,000,000 RA (foreign currency equivalent) during a calendar month

1% - in case of withdrawal of funds in the amount of more than AMD 1,000,000 RA (foreign currency equivalent) during a calendar month

Commission for cash withdrawals from ATMs of other banks participating in the ArCa system

1%

Commission for cash withdrawal at cash points (POS-terminal) of the Bank

AMD, RUR - 1%,

USD, EUR - 2%

USD, EUR - 2%

Commission for credit lines

The above cash disbursement rates apply

Commission in case of cash withdrawal of loans provided in US dollars

1.5%

In order to replace, reissue the card it is necessary to visit the closest IDBank branch with an identity document and fill in the card replacement/reissuance application. Card reissuance application should be submitted in case of loss, theft of the card, or when the card details become available to third parties, or in case of any suspicious transaction.

The card is a card of ArCa payment system and is provided in AMD, USD, EUR, RUB and for a term of 2 years.

Yes, you can order the card you prefer from IDBank's official website.

Replenishment of the card account is performed through money transfers. No other method of replenishment is provided.

Yes, it is safe to use the payment cards since all the security systems complying with international standards are developed and introduced. In the meantime it is necessary that the client also follows the safety rules. The card's PIN code as well as the CVV/CVC code should be kept confidential, and in case of violation or suspicion of violation of safety rules, it is necessary to immediately apply to the Bank.

The Transfer card is a profitable tool for receiving transfers from abroad. The card account is opened completely free of charge. There are no annual service fees. You can perform non-cash transactions with the card without commission fees, no commission fees apply for cash withdrawal from IDBank's ATMs. More information about the card can be found here .

Notification of transactions on IDBank cards is possible in two ways:

- Free PUSH-notifications directly through the Idram&IDBank app

- paid SMS

The cost of SMS is AMD 15. Inside the application, it is possible to independently define the minimum limit of transactions for which notifications will be sent.

- Free PUSH-notifications directly through the Idram&IDBank app

- paid SMS

The cost of SMS is AMD 15. Inside the application, it is possible to independently define the minimum limit of transactions for which notifications will be sent.

The card is intended for those who frequently receive money transfers from abroad. Moreover, the funds are received within a few minutes through the fast money transfer systems of the Bank.

Information Bulletin

Information Bulletin