General

Advantages

Compare products

Refinancing loans secured with real property

Starting from 15,5%

The loan is provided without up- front fee

The maximum loan amount is 125,000,000 AMD

Consumer loan

Bond secured loans

Loans secured by cash collateral and bonds

Up to 5% of the loan, not more than 5,000,000 AMD

The loan is provided without up- front fee

The maximum loan amount is 125,000,000 AMD

Starting from 6.8 %

The loan is provided in the same currency in which the deposit

Use the money free of interest until the 15th of the following month

Starting from 8.28 %

The maximum loan amount is 250,000,000 AMD

Use the money free of interest until the 15th of the following month

Special offer

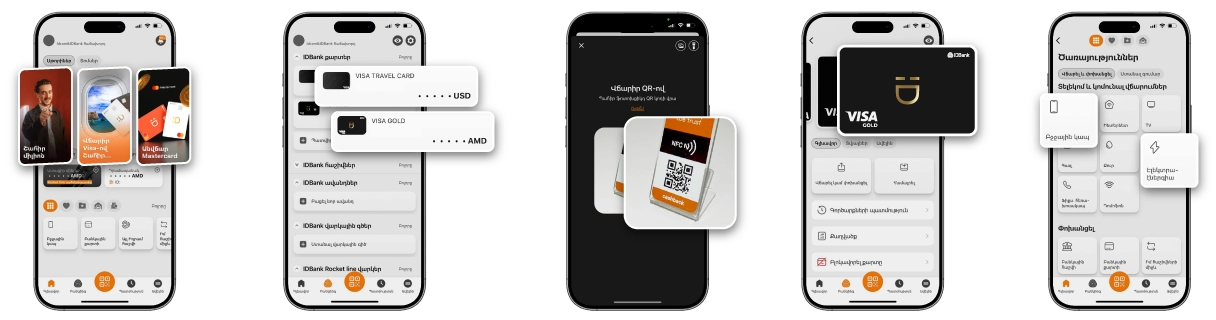

Rocket Line and Rocket Line 0%

Enjoy Rocket Line digital loan of up to 10 million AMD through Idram&IDBank app or IDBanking.am platform. Get now, pay over 60 months. Moreover, you can use Rocket Line 0% when making payment with hundreds of partners, with an actual interest rate of 0% and without additional fees.

Purpose

other

Currency

AMD

Security

residential, public, commercial real estate

Annual interest rate (nominal)

Fixed interest rate for the first 24 months and floating interest rate from 25 to 180 months

For income – based loans/AMD-15%-17.75% /Floating interest rate: IBRR + /5.7%-8.45%/

For loans not based on income/AMD- 15․5% -18․25% /floating interest rate: IBRR1 + /6.2%-8.95%/

For income – based loans/AMD-15%-17.75% /Floating interest rate: IBRR + /5.7%-8.45%/

For loans not based on income/AMD- 15․5% -18․25% /floating interest rate: IBRR1 + /6.2%-8.95%/

Annual interest rate(effective)

Fixed interest rate for the first 24 months and floating interest rate from 25 to 180 months

For income – based loans/AMD-16.91% - 22.42%

For loans not based on income/AMD- 17.60 - 23.03%

For income – based loans/AMD-16.91% - 22.42%

For loans not based on income/AMD- 17.60 - 23.03%

Minimum term

36 months

Maximum term

180 months

Minimum amount

AMD 1,500,000

Maximum amount

AMD 125,000,000

Rocket Line

maximum 10,000,000 AMD

Credit line

In the amount of up to 5% of the total amount of the client's real estate secured loans in the bank the loan, no more than AMD 5,000,000

The credit line can be provided with Visa Travel, idram Rocket and card types specified in the Information bulletin on credit lines.

Determine the remaining terms of the credit line in accordance with the Information bulletin on credit lines.

The credit line can be provided with Visa Travel, idram Rocket and card types specified in the Information bulletin on credit lines.

Determine the remaining terms of the credit line in accordance with the Information bulletin on credit lines.

How the loan is provided

through current account

Repayment of loan and accrued interest

Monthly payments in equal parts, annuity method

Status

RA citizen or RA resident physical entity

Age restrictions

The borrower must be at least 21 and as of the date of loan application and not have exceed 65 by maturity. (The age limit requirement does not apply to the co-borrower if the borrower's (other co-borrower's) financial condition without the co-borrower (co-borrowers) satisfies the repayment of the loan or the loan is provided without substantiation of income)

Requirements to the credit history

-no existing overdue/ classified obligations (loan, credit line, overdraft, guarantees, etc.). -no credit history. - The customer should not be included in the list of unwanted customers of the Bank.

OTI ratio (total debt (average monthly) to net income ratio)

up to 65%

Structure of income and the maximum ratio thereof

According to Annex 1

Pledger

Any individual or legal entity (in the case where the pledgor is a legal entity, it should have state registration in RA)

Appraisal of a subject of collateral

The subject of collateral must be appraised by specialized organizations partners of the Bank, the list of which is available by the following link: List of appraisal companies

Minimum requirements to the subject of collateral

1. The real estate should have masonry, panel or reinforced structure (except for the dividing walls and covers between the floors). 2. The real estate should not be public housing, or located on the territory occupied by other constructions – dormitory. 3. The real estate must not be located on the territory of exclusive public interest. 4. The private house must not have general yard area, general or common property with the other properties

Insurance of the borrower against death and permanent disability resulting from accidents

May be required by the Bank

Insurance of the subject of pledge

May be required by the Bank

Loan application processing fee

Not specified

One-off loan disbursement fee (charged from the contractual loan amount at the moment of the loan disbursement)

NE

Monthly loan service fee calculated for the loan balance

0.1%

Bank account opening/closing fee

In accordance with tariffs in force at the Bank, available through the following link: Information Bulletin on Tariffs

Commission for encashment of loan amount (for loans issued without payment cards)

Not specified

Payment card fees

In accordance with information bulletins for the cards valid in the Bank, except for the commission for temporary or permanent revision of limits, defined free of charge.

To the overdue loan, daily

0.12%

To overdue interest, daily

0.12%

Early repayment fee

Not specified for loans in the amount of up to 15,000,000 AMD (inclusively). For loans equal and above 15,000,000 AMD – 3 % of the early repaid amount, if such early repaid amount exceeds aggregate of principal amount for the 6 months following the date of early repayment, as provided by the repayment schedule.

Master loan agreement

The Bank concludes a master loan agreement with the client for a period of up to 180 months and in the amount of up to 100% of the market value of the real estate

Positive factors based on which the loan may be extended

1) Good credit history, 2) Stable cash flows, 3) compliance of the subject of collateral with the requirements of the Bank 4) Other factors

Negative factors for the loan decision-making

1) negative credit history, 2) Incompliance of the collateral with the requirements of the Bank 3) provision of false or unreliable information, 4) provision of such information, which rise suspicion to the return of the loan, 5) absence of email address of the client, 6) negative credit history of the person affiliated with the client, if the Bank considers that the client's income can be used to fulfill the obligations of the affiliated person or the income of the affiliated person can be used to fulfill the obligations of the client

Maximum term of taking decision

Maximum 2 business day after submitting all required documents to the Bank

Maximum terms for giving notice to the customer

1 business day. The borrower may be notified of the loan decision in the Bank’s premises, by phone call or e-mail

Maximum validity period

30 business days.Within three months after the expiration date of the approved loan decision, the loan decision can be reaffirmed without submitting an additional application, unless the credit history and income of the borrower (co-borrower) and family members have not changed significantly.If necessary, the Bank may require to update the documents substantiating the income.

Term of loan disbursement

1 business day after submitting document, which confirms the right with regard to the collateral

Place of acceptance, registration and providing the loan application

All branches of the Bank

The list of documents to be submitted by the Customer to the Bank

According to Annex 2

Annual nominal interest rate

Current interest rate of the loan, reduced by up to 2 percentage points (in case of loan refinancing in the same currency) but no less than 15.5%

Effective annual interest rate

From 16.6%

Type of the interest rate

Fixed interest rate for the first 24 months and floating interest rate starting from the 25th month

idcoin

1% of the amount of refinancing idcoin

The opportunity to receive idcoin is provided until the 5th business day of the month following the date of receipt of the loan. The amount of idcoin to be actually received is determined based on the reduction of taxes payable in accordance with the legislation of the Republic of Armenia in case of their full use. A mobile phone number registered at the bank is used to provide the opportunity to receive idcoin. However, if the bank does not have a registered phone number or it is incomplete, the opportunity to receive an idcoin is not provided.

The opportunity to receive idcoin is provided until the 5th business day of the month following the date of receipt of the loan. The amount of idcoin to be actually received is determined based on the reduction of taxes payable in accordance with the legislation of the Republic of Armenia in case of their full use. A mobile phone number registered at the bank is used to provide the opportunity to receive idcoin. However, if the bank does not have a registered phone number or it is incomplete, the opportunity to receive an idcoin is not provided.

Maximum loan amount

The contractual amount of the client's current loan + an additional amount of maximum 30%. Maximum and minimum amounts according to clause 8 and clause 9 of these terms and conditions

Maximum loan term

Contractual maturity of the client's current loan + 30% extension of maturity date. The minimum term of the loan shall be at least 36 months, and the maximum term shall not exceed 180 months

Target group of borrowers

55.1. transfer of an existing liability/liabilities secured by movable or immovable property serviced for at least 12 months in other banks/lending organizations, with the possibility of increasing the amount,

55.2 granting loans to those clients, who had a loan secured by real estate serviced in other banks/lending organizations for at least 12 months, with a final repayment within 6 months preceding the moment of applying for a loan. In case of transfer of existing obligations that have served for 12 months or more, there is no income requirement.

In cases stipulated by clauses 55.1 and 55.2 of these terms and conditions:

1) Loans can be refinanced to persons affiliated with the borrower. For the purposes of these terms and conditions, an affiliated person is father, mother, child, spouse, sister, brother of the borrower. In this case, the Bank may require a document certifying the kinship (marriage certificate, birth certificate, etc.)

55.2 granting loans to those clients, who had a loan secured by real estate serviced in other banks/lending organizations for at least 12 months, with a final repayment within 6 months preceding the moment of applying for a loan. In case of transfer of existing obligations that have served for 12 months or more, there is no income requirement.

In cases stipulated by clauses 55.1 and 55.2 of these terms and conditions:

1) Loans can be refinanced to persons affiliated with the borrower. For the purposes of these terms and conditions, an affiliated person is father, mother, child, spouse, sister, brother of the borrower. In this case, the Bank may require a document certifying the kinship (marriage certificate, birth certificate, etc.)

Other requirements

- Total amount of overdue days on the client's loans during the last 24 months preceding the submission of the loan application should not exceed 50 days, and for the transferred loans - 10 overdue days,

- loans transferred during the last 3 months preceding the date of application must be classified as "standard" loans

- loans transferred during the last 3 months preceding the date of application must be classified as "standard" loans

Loan application processing fee

Not specified

Up-front fee

Not specified

Monthly service fee

Not specified

Pledging related costs

Costs to be borne by the Bank for executing the pledge for loans exceeding AMD 4,000,001.

- Collateral appraisal fee (appraisal is not required if the property pledged at the Bank was appraised during the most recent 12 months, or any other banks/financial organizations during the most recent 6 months preceding the date of application by one of the appraising companies – partners of the Bank).

- fee for unified reference issued by the Real estate Cadaster State Committee of the RA Government ,

- Fee for notarization of real estate, subject of collateral.

- Fee for registration of the title of the Bank resulted from the pledge agreement in the state competent authority.

*The fee for a Unified Reference issued by the State Committee of the Real Estate Cadastre adjunct to the Government of the Republic of Armenia and the fee for registration of the Bank's right arising from the Pledge Agreement, in case of registration through the ARPIS program operating in the Bank, shall not be charged.

If the pledge-related expenses are covered by the Bank, and the borrower repays the loan in full ahead of the schedule within 24 months following the transfer, the borrower reimburses the expenses incurred by the Bank specified in this clause.

- Collateral appraisal fee (appraisal is not required if the property pledged at the Bank was appraised during the most recent 12 months, or any other banks/financial organizations during the most recent 6 months preceding the date of application by one of the appraising companies – partners of the Bank).

- fee for unified reference issued by the Real estate Cadaster State Committee of the RA Government ,

- Fee for notarization of real estate, subject of collateral.

- Fee for registration of the title of the Bank resulted from the pledge agreement in the state competent authority.

*The fee for a Unified Reference issued by the State Committee of the Real Estate Cadastre adjunct to the Government of the Republic of Armenia and the fee for registration of the Bank's right arising from the Pledge Agreement, in case of registration through the ARPIS program operating in the Bank, shall not be charged.

If the pledge-related expenses are covered by the Bank, and the borrower repays the loan in full ahead of the schedule within 24 months following the transfer, the borrower reimburses the expenses incurred by the Bank specified in this clause.

*

** Other conditions of loan refinancing not specified in clauses 47-58, are regulated under clauses 1-46 of these terms and conditions.

Information regarding credit history and credit score

You can learn about the importance of credit history and credit score here․

Details via abcfinance.am and acra.am links.

Details via abcfinance.am and acra.am links.

Apply now

Up to 180 months repayment period

Information Bulletin

Information Bulletin