General

Compare products

Gold Standard

The loan is available in Armenian drams

Starting from only 16%

The loan is approved on the day of application

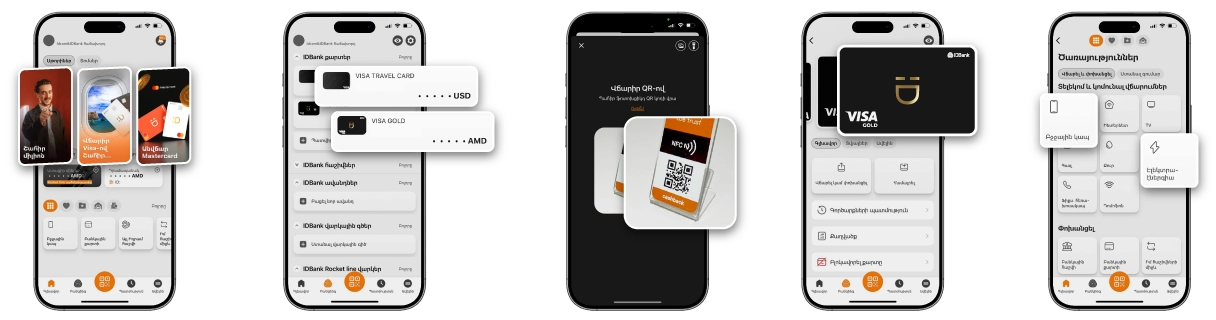

Package IDgold

Visa Gold debit card - discount of 50%

Rocket Line - Provided to the borrower in the amount of up to 10% of the loan

Insurance - Free insurance for accidents

Special offer

IDgold

Use the IDgold package of services for borrowers of gold-secured loans. The package includes favorable terms for the loan, Premium class debit card with 50% discount, Rocket Line digital limit and a bank account with preferential terms.

Loan type

“Gold Standard”

Purpose

other

Currency

AMD

Minimum amount

AMD 30,000

Maximum amount

AMD 30,000,000

Method of loan disbursement

non-cash transfer via current account

Term

3 - 6 months

Annual nominal interest rate

16%

Annual effective interest rate

17.79% - 18.31%

Fees

NE

Maximum loan/collateral ratio

up to 100%

Term

4 - 6 months

Annual nominal interest rate

19%

Annual effective interest rate

20.87% - 20.93%

Fees

NE

Maximum loan/collateral ratio

up to 100%

Term

12-60 months

Annual nominal interest rate

16․7% - 18․7%

Annual effective interest rate

18.12% -20.62%

Fees

NE

Maximum loan/collateral ratio

up to 100%

Grace period of loan repayment2

AMD - During the first 6 months of loan repayment, payments are made only on part of the loan interest

2

In case of using the grace period of loan repayment, the nominal annual interest rate of the loan is set at the current interest rate +1%.

Requirements for the borrower

In case of 95% loan/collateral ratio

1) physical entity whose age shall not be less than 18 years as of the day loan provision and not exceed 70 years as of the loan repayment day,

2)the borrower must not have overdue loan obligations as of the moments of loan provision

3)- the borrower must not have loans classified as stricter than “controlled” for the 6 months preceding the loan provision

In case of 100% loan/collateral ratio

1) physical entity whose age shall not be less than 18 years as of the day loan provision and not exceed 70 years as of the loan repayment day

2) the borrower must not have overdue loan obligations as of the moments of loan provision

3) the borrower must not have loans classified as stricter than “controlled” for the 12 months preceding the loan provision

4) the sum of overdue days of principal loan amount and/or interest amount repayments in terms of borrower’s previously received loans (credit line, overdraft, etc.) must not exceed 60 days for the 12 months preceding the loan provision

5) the borrower must have a credit history of at least 6 months. This point does not apply if the total sum of the balances of the provided loan and the loans secured by the gold collateral held by the client does not exceed AMD 500,000 (including).

1) physical entity whose age shall not be less than 18 years as of the day loan provision and not exceed 70 years as of the loan repayment day,

2)the borrower must not have overdue loan obligations as of the moments of loan provision

3)- the borrower must not have loans classified as stricter than “controlled” for the 6 months preceding the loan provision

In case of 100% loan/collateral ratio

1) physical entity whose age shall not be less than 18 years as of the day loan provision and not exceed 70 years as of the loan repayment day

2) the borrower must not have overdue loan obligations as of the moments of loan provision

3) the borrower must not have loans classified as stricter than “controlled” for the 12 months preceding the loan provision

4) the sum of overdue days of principal loan amount and/or interest amount repayments in terms of borrower’s previously received loans (credit line, overdraft, etc.) must not exceed 60 days for the 12 months preceding the loan provision

5) the borrower must have a credit history of at least 6 months. This point does not apply if the total sum of the balances of the provided loan and the loans secured by the gold collateral held by the client does not exceed AMD 500,000 (including).

Bank account opening/closure fee

In accordance with the tariffs in force in the Bank available at the following link: Information bulletin on bank accounts

Commission for encashment of loan amount

NE

Daily penalty in terms of overdue loan

0.10%

Daily penalty in terms of overdue interest

0.10%

Early loan repayment penalty

not defined

Requirements for the subject of pledge

1) standardized gold bullions, gold jewelry, gold scrap can be considered as subject of pledge

2) white gold, jewelry items consisting of white gold for more than 30 percent or more, or jewelry items that cannot be evaluated without the weight of white gold cannot be subject of pledge

3) no lending is provided against artistic value of gold items, precious and semi-precious stones attached to gold items

2) white gold, jewelry items consisting of white gold for more than 30 percent or more, or jewelry items that cannot be evaluated without the weight of white gold cannot be subject of pledge

3) no lending is provided against artistic value of gold items, precious and semi-precious stones attached to gold items

Required documents

1) identity document (original)

2) social card /public services number/ ID card or number of statement on absence of public services number (if any) (original)

3) in case of physical entities engaged in gold trade and/or production the physical entity shall submit the rental agreement of the place of activity as a proof of activity (notarization is not required)

4) email address of the client

2) social card /public services number/ ID card or number of statement on absence of public services number (if any) (original)

3) in case of physical entities engaged in gold trade and/or production the physical entity shall submit the rental agreement of the place of activity as a proof of activity (notarization is not required)

4) email address of the client

Positive factors for loan provision

Compliance with the Bank’s lending conditions

Loan rejection factors

1) presence of overdue loan obligations at the moment of loan provision

2) failure to submit required documents

3) doubts over the entity or identity document of the latter

4) doubts about the gold fineness during the authentication of the subject of pledge, submission of false or unreliable information or false documents

5) availability of such information about the client which questions the information submitted/declared by the client to the Bank

6) availability of such information about the client which questions the return of the loan

7) absence of the email address of the client

2) failure to submit required documents

3) doubts over the entity or identity document of the latter

4) doubts about the gold fineness during the authentication of the subject of pledge, submission of false or unreliable information or false documents

5) availability of such information about the client which questions the information submitted/declared by the client to the Bank

6) availability of such information about the client which questions the return of the loan

7) absence of the email address of the client

Maximum decision-making term

loan application submission day

Term of notifying the client of the decision

loan application submission day

Loan provision term

loan application submission day

Place of loan application acceptance

all branches of the Bank, except for “Vardanants”, “Centre” and "Old Yerevan" branches

Place of loan processing and provision

all branches of the Bank, except for “Vardanants”, “Centre” and "Old Yerevan" branches

Date

11.08.2025

Assay

The price of 1 gr. of gold (AMD)

375

15,500

500

20,600

560

23,100

585

24,100

750

30,900

875

36,000

900

37,100

958

39,500

999

41,200

Date

11.08.2025

Assay

The price of 1 gr. of gold (AMD)

375

15,800

500

21,000

560

23,500

585

24,500

750

31,500

875

36,700

900

37,700

958

40,200

999

41,900

Information regarding credit history and credit score

You can learn about the importance of credit history and credit score here․

Details via abcfinance.am and acra.am links.

Details via abcfinance.am and acra.am links.

Answer․ The actual interest rate includes the actual costs incurred by the customer for servicing the loan. The loan schedule reflects the interest payable, the principal amount and service fee, if any.

Answer․ any individual with a citizenship, whose age at the date of loan disbursement is not less than 18 years and by the time of loan repayment does not exceed 70 years, can be a borrower.

Answer․ The bank does not provide loan against white gold, as well as for jewelry, in which white gold is more than 30%, or if it is impossible to evaluate the jewelry without the weight of white gold.

Answer. The Bank does not provide loans for the artistic value of gold items, precious and semi-precious stones attached to gold items. The subject of the pledge can be standardized gold bars, gold jewelry, gold scrap.

Answer․ The bank can provide you with 100% of the estimated value of your gold items. However, if your credit history meets the requirements of the Bank, the loan/collateral ratio can be unlimited.

Apply now

Up to 30,000,000 AMD loan amount

Starting from only 16%

Information bulletin of "Gold Standard" loans

Information bulletin of "Gold Standard" loans