General

Advantages

Compare products

Student Loan

The interest rate is lower than the interest rate of consumer loans - 9% only

The loan is provided without any commissions

Repay the principal amount after graduation

Repay the loan during up to 10 years

Rocket loans/credit lines

Profi

Rocket online loan

The loan is being approved within a few minutes

You apply online to get the limit without visiting the bank and without paperwork

The loan is provided without any commissions

Use the amount free of interest up to the 25th day of the following month.

Maximum loan amount is 10 000 000 AMD

Interest rate is lower than for the other credit lines - 14-18 % only

The loan is provided without any commissions

Loan approval takes up to 5 minutes

You should apply online to get the limit without visiting the Bank and without any documentation

There is no need to submit any documents

The loan is provided without any commissions

Special offer

Rocket Loan

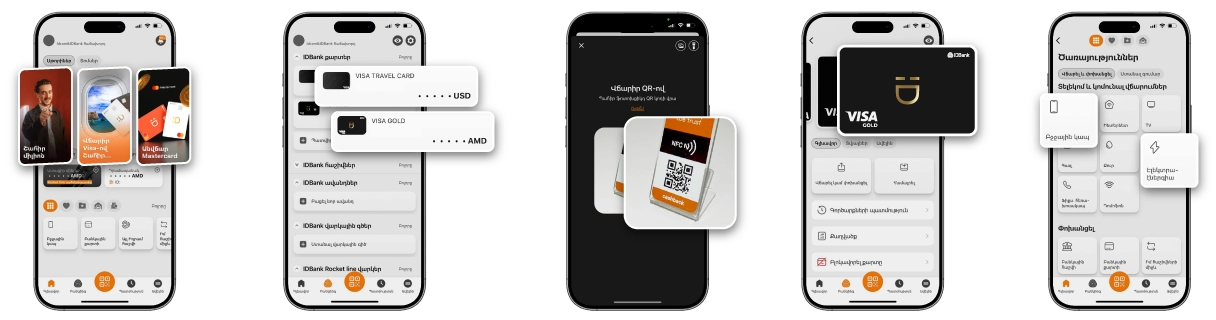

Get a loan of up to 5 million AMD at a rocket speed, without any commission and income proof document. Apply with Idram&IDBank application or IDBanking.am platform, and get the loan directly in the application within 5 minutes. Download the Idram&IDBank app in the App Store or Google Play Store at https://idram.app.link/idram

Purpose of the loan

Payment of tuition fees for students of Bachelor’s and Master’s degrees, as well as Clinical residency of RA State Higher Educational Institutions and those accredited by the RA

Currency of the loan

AMD

Minimum term of the loan

12 months

Maximum term of the loan

Term of studies + 6 years, no more than 10 years (the loan may be provided for a shorter period upon the client’s consent only) the term of studies shall be deemed to the be the years of studies by Bachelor’s, Master’s program or Clinical residency

Minimum loan amount

Not specified

Maximum loan amount

700,000 AMD, but no more than the amount of one year tuition fee. Moreover, 1 loan only may be provided for each academic year

Total amount of loans provided during the term of studies

For 4 academic years, maximum 2,800,000 AMD

Method of repayment

monthly equal payments, moreover, during the studies the borrowers pay interest only (up to 4 years), while after graduation the principal amount of the loan and interest payments are paid off equally

Annual nominal interest rate

9%, of which 2% to be subsidized by the government for all students, 3% to be subsidized by the government for students with excellent progress for the last year. Within the framework of the 14th program of the Government of the Republic of Armenia “Neutralization of Economic Consequences of Coronavirus”, the following conditions will apply for subsidizing the loans from May 1st to December 31st, 2020: 1. Students whose total average quality grades are 80% and higher starting from the beginning of study to the first term of the 2019-2020 academic year, will get full state subsidiary of the interest rate of their new and existing loans in the period 01/05/2020-31/12/2020. 2. Students whose total average quality grades are less than 80% starting from the beginning of study to the first term of the 2019-2020 academic year, will get 5% state subsidiary of the interest rate of their new and existing loans in the period 01/05/2020-31/12/2020.

Annual actual interest rate

9.38%

Loan disbursement/service fee

Not specified

Opening and maintaining of current account

Free of charge

Fine/penalty for overdue loan /interest

0.1% daily

Early repayment fee

Not specified

Disbursement method

Non-cash, by transferring the amount on the account of the HEI

Security

1 guarantor at least

Status of the borrower

1) RA citizen physical person. 2) Bachelor’s or Master’s program students or clinical residency students of paid education system of RA state HEI or state accredited HEI

Requirements to the guarantors

1) the guarantor/ at least one of the guarantors (if there are more than 1 guarantors) must be a parent/custodian of the borrower (for parentless and adult students the guarantor may be the third party), 2) the guarantor must have an income (in case of more than one guarantor at least one of them must have an income), 3) By the date of loan application, the guarantor must be an adult of 21-68 years

Requirements to the credit history (for the first and each next stage of providing the loan) of the borrower/ guarantor

1) by the date of loan application, the borrower/guarantor must not have any overdue obligations (loan, credit line, overdraft, guarantees, etc.) 2) aggregate days on overdue obligations of the borrower/guarantor over the year (365 days) preceding the date of application must not exceed 30 days 3) the guarantor had no nonperforming loan obligations over the two years preceding the date of loan obligations 4) No credit history is acceptable 5) The customer should not be included in the list of unwanted customers of the Bank.

Positive factors for loan provision

Good credit history

Factors for loan rejection

1) Bad credit history, 2) providing of false or unreliable information, 3) provision of such information, which puts return of the credit line into suspicion, 4) the loan, which has been provided to a student within the scope of this program before, was recognized as unqualified by a refinancing organization 5) other factors

Maximum term for making decision

Maximum 2 business days after submitting all required documents to the Bank

Terms for notifying the borrower about the decision made

Maximum 1 business day after making decision. The borrower may be notified of the loan decision in the Bank’s premises, by phone call or e-mail

Term during which the loan is provided

Maximum 1 business day after making positive decision

Maximum term, during which the decision remains valid

15 business days

Place of acceptance, registration and providing the loan application

All branches of the Bank

Documents to be submitted by the client /guarantor to the Bank

According to annex 1.1

Information regarding credit history and credit score

You can learn about the importance of credit history and credit score here․

Details via abcfinance.am and acra.am links.

Details via abcfinance.am and acra.am links.

Answer: No, the loan amount is directed for payment of tuition fees for Bachelor, Master, and clinical residency students of RA state or RA state accredited higher educational institutions.

Answer: A loan is provided for each academic year with a maximum tuition fee of one year. In general, a loan can be provided for four academic years.

Answer ․ You need at least one guarantor to get a student loan.

Answer․ The guarantor or at least one of the guarantors, if there are more than 1 guarantor, must be your parent/guardian (the third person can be the guarantor for bilateral orphan or for adult students).

Answer․ The guarantor or at least one of the guarantors, if there are more than 1 guarantor, must have an income.

Answer․ The state subsidizes 2% for all students and 3% for students who have excelled in the previous academic year.

Apply now

0% commission

Up to 10 years repayment period