General

Advantages

Compare products

Renovation Mortgage Loans. Own resources

2 options of interest repayment are available

Maximum loan amount is 125 000 000 AMD/250 000 USD

The loan is available in Armenian drams and US dollars

For the purchase. Own resources

Renovation Mortgage Loans. National mortgage company

Rocket Line - Up to AMD 10 000 000

The loan is available in Armenian drams

In case of joining IDsalary package interest rate lower by 0.25%

Pay off in up to 240 months

Credit line - In the amount of up to 5% of the mortgage loan

Annual nominal interest rate starts from 13.5%

Pay off in up to 180 months

Special offer

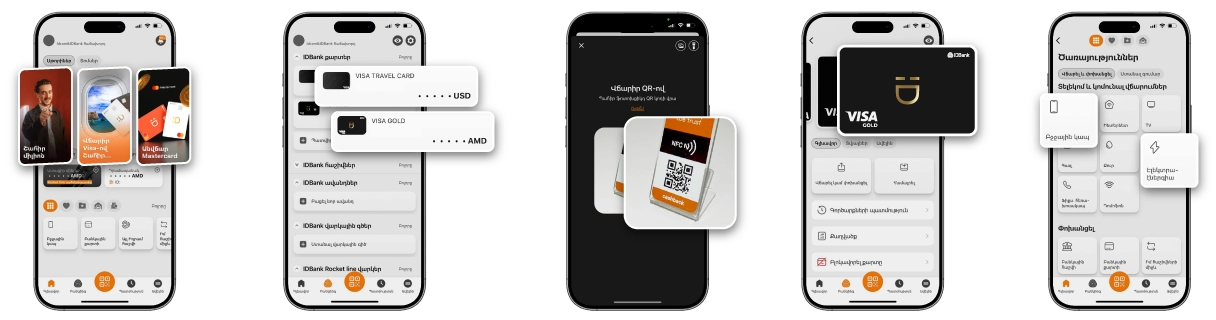

Rocket Line and Rocket Line 0%

Enjoy Rocket Line digital loan of up to 10 million AMD through Idram&IDBank app or IDBanking.am platform. Get now, pay over 60 months. Moreover, you can use Rocket Line 0% when making payment with hundreds of partners, without any interest rate or additional payment. with an actual interest rate of 0% and without additional fees.

Loan purpose

Renovation of real estate property

Loan currency

AMD

USD*

*-Loans in USD are provided exclusively/solely to physical entities who are not residents of the Republic of Armenia

USD*

*-Loans in USD are provided exclusively/solely to physical entities who are not residents of the Republic of Armenia

Minimum loan amount

AMD 3,000,000 or equivalent in USD

Maximum loan amount

AMD 125,000,000 Up to USD 250,000

Minimum loan term

60 months

Maximum loan term

120 months

Nominal annual interest rate for AMD

Fixed(for the first 12 months): 14%-16% / Floating(from 13th to 120th months): IBRR+(4.7%-6.7%)

Nominal annual interest rate for USD

Fixed(for the first 12 months): 10%-13% / Floating(from 13th to 120th months): IBRR + (6.1%- 9.1%)

Effective annual interest rate

AMD 14.90% - 18.94% / USD 10.57% - 15.99%

Security (pledge)

1) Real estate property being renovated or 2) Real estate property being renovated and other real estate property (residential/public)

Maximum loan/collateral ratio

70%

Loan disbursement method

1. non-cash through current account, 2. one-time or by installments according to the decision of the Bank?s competent body

Method of loan and interest repayment

1. Annuity repayment method - Equal monthly repayments of the sum of loan principal and interest amount, in case of change of the annual nominal interest rate during the loan period, the method of repayment of the loan and interest amounts can be changed.

Loan application revision fee

Not specified

One-time loan disbursement fee

Not specified

Bank account opening/closing

Opened in the loan currency according to the tariffs applied in the Bank. If the loan currency is other than AMD, an account in AMD shall also be opened.

Commission for encashment of loan amount and prepayment

Not specified

Pledger

the borrower and/or coborrower, or any physical or legal entity in case of other real estate property (other pledge)

Status of the borrower/coborrower

RA citizen physical entity

Age restriction

Borrower - physical entity over 21 years old whose age must not exceed 65 years by the loan maturity, Coborrower - a physical entity over 21 years old whose age must not exceed 65 years at the moment of loan disbursement (the age restriction requirement shall not be applied if based on the information submitted in the application form the financial state of the borrower (other coborrowers) is enough to repay the loan without the given coborrower (coborrowers).

General principle of borrower/coborrower?s creditworthiness assessment

Maximum total debt repayments to net incomes (OTI) ratio must not exceed: 55%

Incomes of the borrower/coborrower

1) Composition of primary incomes - according to Appendix 1, 2) Composition of secondary incomes - according to Appendix 1

Requirements to the borrower?s/coborrower?s credit history

1. Absence of credit history or 2. Absence of overdue liabilities towards the financial-banking system as of the date of acceptance of the loan application (in terms of loans, credit lines, overdrafts, provided guarantee etc.), and 3. Less than 30 total overdue days in terms of loan principal amount and/or interest repayments in terms of loans (credit line, overdraft, guarantee etc.) received within the 12 months preceding the loan application submission date.

Loan rejection factors

1. Non-compliance with the conditions of the loan type

2. Adverse credit history of the client

3. Adverse credit history of the person affiliated with the client

4. Insufficient income

5. Insufficient level of creditworthiness

6. Insufficient level of collateral liquidity from the bank's perspective

7. An undesirable client for the bank

8. Provision of false or unreliable information

9. Availability of information casting doubt on loan repayment

10. Lack of a client email address

11. Other reasons

2. Adverse credit history of the client

3. Adverse credit history of the person affiliated with the client

4. Insufficient income

5. Insufficient level of creditworthiness

6. Insufficient level of collateral liquidity from the bank's perspective

7. An undesirable client for the bank

8. Provision of false or unreliable information

9. Availability of information casting doubt on loan repayment

10. Lack of a client email address

11. Other reasons

FINES, PENALTIES

Penalty for overdue principal amount - 0.1% daily. Penalty for overdue interest amount - 0.1% daily. In case of early loan repayment: - 0.6% of early repaid amount for the 1st year of the loan agreement, - 0.4% of early repaid amount for the 2nd year of the loan agreement, - 0.2% of early repaid amount for the 3rd year of the loan agreement, - No early repayment penalty is charged after the 3rd year of the loan agreement. No early repayment penalty is charged for the amount which does not exceed the aggregate sum of principal amount repayments provided by the repayment schedule for the 12 months following the early repayment. In case of non-targeted use of the loan the Bank is entitled to demand: 1) early repayment of the whole loan amount, 2) penalty in the amount of 25% of the misused loan amount, 3) revision of loan interest rate according to the competent body if the Bank.

Insurance Performed by the Bank

Presented in Appendix 2

Requirements to the subject of pledge

Presented in Appendix 3

Place of acceptance of the application and documents

All branches of the Bank

Loan decision making and notification of the client

Up to 3 business days after submission of a complete package of documents required by the Bank

Loan disbursement term

Maximum 3 business days after submission of complete package of documents and registration of the right of pledge after the decision has been made

Validity of the loan decision

30 business days

Loan application revision fee

Not specified

One-time loan disbursement fee

Not specified

Pledge related costs

The pledge related costs incurred by the Bank for loans amounting to AMD 15,000,000 and more are as follows: - collateral appraisal fee (no appraisal is required if the given property is already pledged in the Bank and has been appraised within 12 months preceding the submission of the loan application, or 6 months preceding the submission of the loan application in case if the property is pledged in other banks/credit organizations, by appraisal companies cooperating with the Bank), - Fee for the unified reference provided by the state cadaster committee under the RA Government*, - Notarization fee for the real estate that is the subject of collateral - Fee for registration of the Bank?s right arising from the pledge agreement in the competent state body. *in case if the fees for the unified reference provided by the state cadaster committee under the RA Government and for registration of the Bank?s right arising from the pledge agreement in the competent state body are made through the ARPIS program applied in the Bank, no reference fee shall be charged. In case if the costs are incurred by the Bank the borrower shall reimburse to the Bank the costs incurred by the latter mentioned in this provision in case if the borrower completely repays the loan ahead of time within 24 months following the transfer.

List of documents to be submitted by the client

according to Appendix 4

Information regarding credit history and credit score

You can learn about the importance of credit history and credit score here?

Details via abcfinance.am and acra.am links.

Details via abcfinance.am and acra.am links.

Apply now

Starting from 10%

Up to 120 months repayment period

Information bulletin

Information bulletin