General

Special offer

Rocket Line and Rocket Line 0%

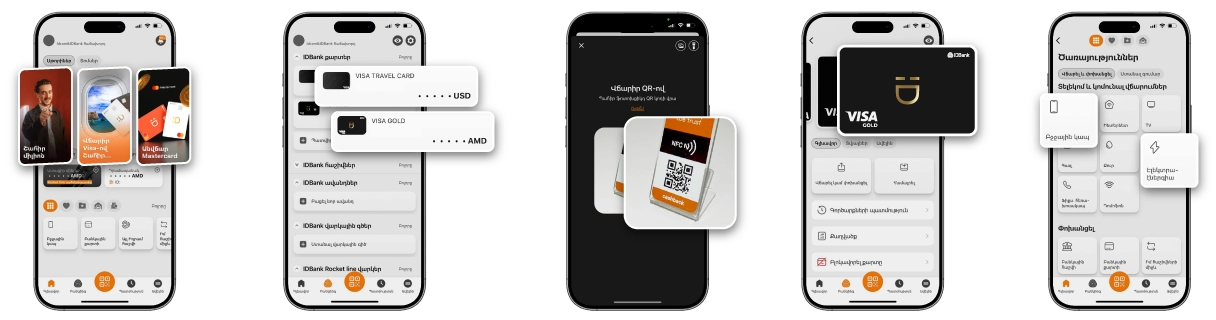

Enjoy Rocket Line digital loan of up to 10 million AMD through Idram&IDBank app or IDBanking.am platform. Get now, pay over 60 months. Moreover, you can use Rocket Line 0% when making payment with hundreds of partners, with an actual interest rate of 0% and without additional fees.

Loan purpose

Energy efficient renovation of apartments or individual residential houses

Loan currency

AMD

Minimum loan amount

300,000 AMD

Maximum loan amount

7,000,000 AMD

Rocket Line

Up to 10% of the mortgage loan, not more than AMD 10 000 000 AMD

Minimum loan term

60 months

Maximum loan term

84 months

Nominal annual interest rate

14% fixed interest rate

Effective annual interest rate

from 14.90%

State subsidized interest rate

9% - in Yerevan

11% - in urban areas

12% - in rural areas

14% - in border areas or high mountain areas

11% - in urban areas

12% - in rural areas

14% - in border areas or high mountain areas

Security (pledge)

The renovated real estate property may be required to be pledged. In case of collateral, the requirements to the collateral are described in Annex 3, other requirements are established in the information bulletin for Renovation Mortgage Loans

Method of loan disbursement

Non-cash transfer made in a lump sum or installments

Grace period

NE

Method of loan and interest repayment

Annuity – the loan is repaid in equal monthly installments, consisting of the loan principal and interest charges

Loan application processing fee

NE

One-time loan disbursement fee

NE

Bank account opening

in accordance with tariffs of bank accounts, transfers and other services provided by “IDBANK” CJSC for physical entities

Commission for encashment of loan amount

NE

Requirements to the renovated real estate

Residential real estate is located on the territory of the Republic of Armenia and belongs to the borrower or a member of his/her family

Preliminary conditions for loan issuance

1)The renovation is considered energy-efficient, where out of the total cost of measures aimed at increasing energy efficiency, for purchase, installation or replacement of alternative energy sources, use of energy–efficient construction materials, energy-saving heating systems, exterior doors and windows, and in the case of an individual residential house - for thermal insulation of external covering and enclosing structures the following part of the loan amount is used:

2) At least 20% of the loan amount – for apartments

3) At least 30% of the loan amount – for individual residential houses

1. The energy efficiency assessment based on the above requirements is carried out using online energy efficiency calculation tools, like "Warm Hearth" or "My Roof"

2. The amount allocated for the purchase of household appliances cannot exceed 10% of the total loan amount (household appliances that can be bought with the loan include refrigerators, washing machines, dishwashers, electric ovens, electric stoves, electric water heaters with energy efficiency class A+). The purchase of household appliances is not considered as energy efficient measure.

3. The use of the loan in the authorized expenditure areas is carried out through non-cash transactions in the amount of at least 70% of the total loan amount. At least 80% of the expenditure areas of the loan and 100% of the expenses allocated for energy-efficient measures must be substantiated through relevant documents (payment order, cash receipt, payment by invoice, bank or card transfer, a document confirming the fact of acceptance and delivery of goods, work or services).

4. Energy-efficient measures that fail to provide documents confirming payment are not considered as energy-efficient measures. In order to use the loan funds, it is necessary to present preliminary and final photographs and/or video recording summarizing the renovation work.

2) At least 20% of the loan amount – for apartments

3) At least 30% of the loan amount – for individual residential houses

1. The energy efficiency assessment based on the above requirements is carried out using online energy efficiency calculation tools, like "Warm Hearth" or "My Roof"

2. The amount allocated for the purchase of household appliances cannot exceed 10% of the total loan amount (household appliances that can be bought with the loan include refrigerators, washing machines, dishwashers, electric ovens, electric stoves, electric water heaters with energy efficiency class A+). The purchase of household appliances is not considered as energy efficient measure.

3. The use of the loan in the authorized expenditure areas is carried out through non-cash transactions in the amount of at least 70% of the total loan amount. At least 80% of the expenditure areas of the loan and 100% of the expenses allocated for energy-efficient measures must be substantiated through relevant documents (payment order, cash receipt, payment by invoice, bank or card transfer, a document confirming the fact of acceptance and delivery of goods, work or services).

4. Energy-efficient measures that fail to provide documents confirming payment are not considered as energy-efficient measures. In order to use the loan funds, it is necessary to present preliminary and final photographs and/or video recording summarizing the renovation work.

Insurance

Maintained by the Bank in accordance with Appendix 2 (in some cases it may not be required).

Fees for pledge registration (in case of pledged property)

Paid by the client

Status of the borrower/co-borrower

RA citizen physical entity

Age restriction

borrower – physical entity over 21 years old, whose age must not exceed 65 years by the loan maturity.

co-borrower- physical entity over 21 years old, whose age must not exceed 65 years at the moment of loan disbursement (the age restriction requirement shall not be applied if based on the information submitted in the application form the financial state of the borrower (other co-borrowers) is enough to repay the loan without the given co-borrower (co-borrowers).

co-borrower- physical entity over 21 years old, whose age must not exceed 65 years at the moment of loan disbursement (the age restriction requirement shall not be applied if based on the information submitted in the application form the financial state of the borrower (other co-borrowers) is enough to repay the loan without the given co-borrower (co-borrowers).

General principle of assessment of borrower’s/co-borrower’s creditworthiness

Maximum ratio of all outstanding obligations to the estimated net income (OTI ratio)` 45%-60%

Borrower's/co-borrower's incomes

Composition of incomes in accordance with Appendix 1

Requirements to the Borrower's/co-borrower's credit history

1․ Absence of credit history or

1.1 Absence of overdue liabilities towards the financial-banking system as of the date of acceptance of the loan application (in terms of loans, credit lines, overdrafts, provided guarantee etc.), and

2.Less than 30 total overdue days in terms of loan principal amount and/or interest repayments in terms of loans (credit line, overdraft, guarantee etc.) received within the 12 months preceding the loan application submission date.

2.1 The Client should not be included in the list of undesirable clients of the Bank.

1.1 Absence of overdue liabilities towards the financial-banking system as of the date of acceptance of the loan application (in terms of loans, credit lines, overdrafts, provided guarantee etc.), and

2.Less than 30 total overdue days in terms of loan principal amount and/or interest repayments in terms of loans (credit line, overdraft, guarantee etc.) received within the 12 months preceding the loan application submission date.

2.1 The Client should not be included in the list of undesirable clients of the Bank.

Loan rejection factors

1. Non-compliance with the terms of the loan

2. Negative credit history

3. Adverse credit history of the person affiliated with the client

4. Insufficient income

5. Insufficient level of creditworthiness

6. Insufficient level of collateral liquidity from the bank's perspective

7. An undesirable client for the bank

8. Provision of false or unreliable information

9. Availability of information casting doubt on loan repayment

10. Lack of a client email address

11. Other reasons

2. Negative credit history

3. Adverse credit history of the person affiliated with the client

4. Insufficient income

5. Insufficient level of creditworthiness

6. Insufficient level of collateral liquidity from the bank's perspective

7. An undesirable client for the bank

8. Provision of false or unreliable information

9. Availability of information casting doubt on loan repayment

10. Lack of a client email address

11. Other reasons

PENALTIES, FINES

Penalty for overdue principal amount – 0.1% for each day of delay

Penalty for overdue interest amount – 0.1% for each day of delay

in case of early repayment of the loan amount, no penalty is charged

In case of non-targeted use of the loan, the Bank is entitled to demand:

1) early repayment of the entire loan amount

2) penalty in the amount of 25% of the misused loan amount,

3) revision of loan interest rate as authorized by the competent body if the Bank.

Penalty for overdue interest amount – 0.1% for each day of delay

in case of early repayment of the loan amount, no penalty is charged

In case of non-targeted use of the loan, the Bank is entitled to demand:

1) early repayment of the entire loan amount

2) penalty in the amount of 25% of the misused loan amount,

3) revision of loan interest rate as authorized by the competent body if the Bank.

Place of acceptance of application and other documents

All branches of the Bank

Decision-making on loan issuance and notification of the client

Up to 3 business days after the submission of the full package of documents requested by the Bank

Loan disbursement date

Within 3 business days after the submission of the complete package of documents and registration of the right of pledge (if available) following the decision on loan issuance

Validity the loan issuance decision

30 business days

Master loan agreement

The Bank can conclude a master loan agreement with the client for a term of up to 240 months and in the amount of up to 100% of the market price of the real estate.

List of documents and required information to be submitted by the client

1. Identity document

2. Social card/public service number (PSN)/ identity card/(reference on absence of PSN)

3. Income documentation

4. Certificate of registration of ownership of the renovated apartment or residential house

5. A report issued by licensed persons (the report issuance date should not exceed 10 years), as a result of inspection of the technical condition of the apartment (residential building) built before 2010 on the absence of 4th degree damage

6. Client’s e-mail address

7. Photos or video recording of the renovated real estate property

8. In case of pledge, a list of additional documents related to the pledge, in accordance with the information bulletin on "Renovation Mortgage Loans".

2. Social card/public service number (PSN)/ identity card/(reference on absence of PSN)

3. Income documentation

4. Certificate of registration of ownership of the renovated apartment or residential house

5. A report issued by licensed persons (the report issuance date should not exceed 10 years), as a result of inspection of the technical condition of the apartment (residential building) built before 2010 on the absence of 4th degree damage

6. Client’s e-mail address

7. Photos or video recording of the renovated real estate property

8. In case of pledge, a list of additional documents related to the pledge, in accordance with the information bulletin on "Renovation Mortgage Loans".

Information regarding credit history and credit score

You can learn about the importance of credit history and credit score here․

Details via abcfinance.am and acra.am links.

Details via abcfinance.am and acra.am links.

Energy-efficient renovation loans are provided within the framework of the State Assistance Programme, which offers mortgage loans for energy-efficient renovation of your apartment or individual residential house and provides partial or full subsidies of the loan interest rate.

Energy-efficient renovation includes purchase of energy-efficient building materials as well as carrying out the following measures: thermal insulation of walls, roofs, inter-floor constructions; purchase, replacement or installation of exterior doors and windows; purchase, replacement or installation of heating or water heating boiler (based on gas supply or electricity) and heating system components (pipes, sections, etc.); purchase and installation of cooling systems, energy-efficient ventilation fan, air conditioner; purchase and installation of solar systems (water heating, photovoltaic system); purchase of LED lamps and light fixtures.

The following part of the loan amount shall be used for energy-efficient measures:

1) At least 20% of the loan amount – for apartments

2) At least 30% of the loan amount – for individual residential houses

1) At least 20% of the loan amount – for apartments

2) At least 30% of the loan amount – for individual residential houses

Renovation under the program must be completed at least 12 months after the issuance of the full loan amount.

When issuing more than one loan under the Programme to the same borrower, for different apartments, as well as applying the condition of termination of subsidy payments in case of taking а loan from other financial organizations (or from the same financial organization) more than once, according to the clauses above, within the framework of the Programme, in case of one apartment (residential house) the interest rate is subsidized only for one loan, taking into account that the fact of receiving a loan from different financial organizations under the Programme for the same apartment (residential house) serves as a basis for termination of subsidy payments. This, however, does not limit the right of the same person to re-use the Programme and take a loan from the same or other financial organizations under the Programme for different apartments (residential houses) in compliance with the conditions established by the Programme and the Procedure.

The purchase of household appliances shall not exceed 10% of the loan amount, but the State Assistance Programme does not cover the costs associated with the purchase of furniture.

Apply now

Effective annual interest rate-from 14.90%

Up to 84 months repayment period

Information bulletin

Information bulletin