Principles and business lines

The Bank carries out its activities and follows the Civil Code of RA, normative acts adopted by the CBA, RA laws regulating banking activities and other laws, and internal legal instruments of the Bank.

In the terms of current bank system, the Bank provides services on the basis of internal legal acts and on contractual basis, remaining faithful to those principles, which create the most confidence atmosphere, transparent opportunities and service conditions for those who applied to the Bank and the Clients benefiting from the services provided by the Bank.

The Bank follows the principles of comfortableness and increase of service quality; that is why the Head office and the branches of the bank has implemented “single window” service principle.

Being in the controlled zones of possible risks the Bank follows the principle of stable level of profitability.

In its tariff policy the Bank follows the competitive tariff rates applicable in the banking system of the Republic of Armenia. Relations between the Council and the executive body of the Bank are based on the provisions set forth by the Charter of the Bank; final resolution of strategic issues of the Bank is assigned to the Council of the Bank. Relations between managers and employees of the Bank are based and followed by the hierarchy structure of the Bank.

In the terms of implementation of new banking services and technologies the Bank leads an active policy, thanks to which the Bank increases customer service quality and gains additional profit.

The Bank carries out its activities through a wide range of banking operations and services at the same time taking into account the risk level of the products offered by the Bank. In implementation of its activities the Bank follows the realization of its basic meaning.

The key directions of the Bank activities:

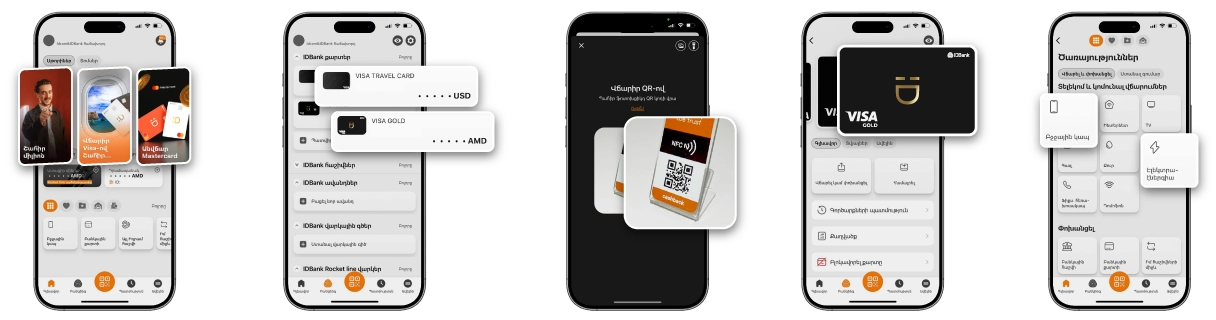

Retail banking: providing such services to individuals, as loans and deposits, money transfers through remittance systems, service of operational accounts, providing individual safe boxes, payment card operations and internet/mobile banking.

Corporate banking: the target clients in this segment are the economic entities engaged in the micro, small and medium business areas, which are offered business loans financed by international programs, trade finance instruments, credit lines extended under salary projects, account service operations, etc.

Anti-bribery and corruption policy

"ID Bank" CJSC is committed to the principles of conducting ethically sustainable business, which is defined by the Bank’s “Anti-bribery and corruption” policy and aims to;

1) Present the trends of conducting fair business in accordance with high ethical standards,

2) Clarify the types of behaviors that may cause conflicts of interest and corruption - or increase the probability of their occurrence,

3) Ensure that financial and other resources within the Bank are used and directed for assurance of their main functions/operations and are not used by employees for personal and self-serving purposes,

4) Encourage an honest and transparent working environment within the Bank,

5) Define the Bank's management position on the risks of potential corruption and conflicts of interest, and their prevention, as well as to define unacceptable behavior and working style of the Bank and its employees.