On April 5 this year, IDBank issued another tranche of nominal coupon bonds under the abbreviation AMANLBB2HER6 through a public offer.

The total amount of the nominal coupon bonds is USD 5 million. The bonds have a circulation period of 27 months, the annual interest rate is 3%, and the bonds will be paid quarterly.

The bonds will be placed from April 5, 2022 to July 1, 2022 inclusive. After the placement, the bonds will be listed in the "Armenian Stock Exchange" OJSC. The bonds will be quoted through the Marketmaker.

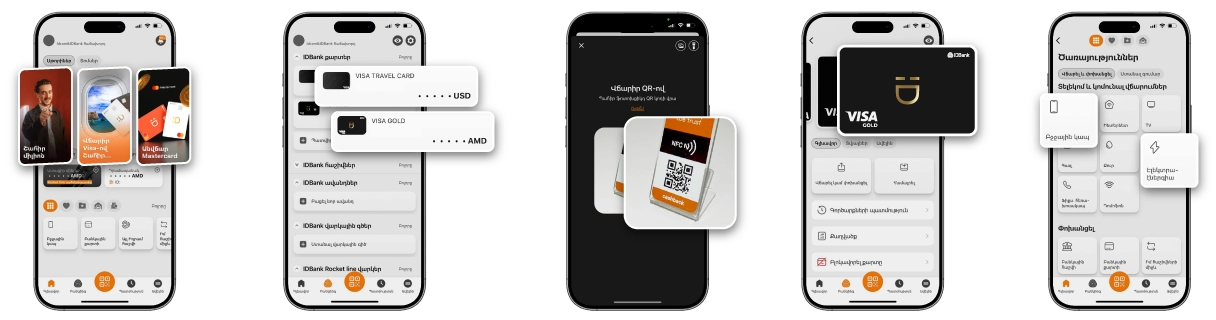

According to the financial director of IDBank Arman Asatryan, the demand for IDBank bonds remains high. The process of buying IDBank's bonds is simplified as much as possible, and all the necessary information about already purchased bonds can be seen in the "Banking" section of the Idram&IDBank application. It indicates the distinctive code of the bonds, the quantity, the nominal value, the annual coupon yield, the days of the coupon payment and the redemption of the bonds,” says Arman Asatryan.

To get IDBank bonds it is necessary to fill in the form and present it to the Bank. You can get the detailed information about the bonds of the fifth issue of 2021 here.

The Bank informs also that the funds attracted by means of nominal bonds are considered to be guaranteed bank deposits and are guaranteed by the Deposit Guarantee Fund of Armenia.

The Bond prospectus was registered by the CBA, resolution N1/392A of the Chairman of the CBA from July 23, 2021. The electronic version of the prospectus and the final terms of issue are available on the official website of the Bank.

THE BANK IS CONTROLLED BY CBA