How did the main activity and the strategy of the Bank change after attracting a new shareholder?

As I have already mentioned in my previous interviews, 2016 was a real turning point for Anelik Bank, and attraction of a new shareholder brought about big changes both from the ideological point of view, and in the very essence of implementing the strategy. A number of strategic decisions were made which definitely impacted the formation of the new image of the Bank and our approach to clients.

Which main directions would you emphasize?

I would emphasize a number of circumstance which had a sufficient impact on the activity of the Bank as well as on formation of the vision of the Bank.

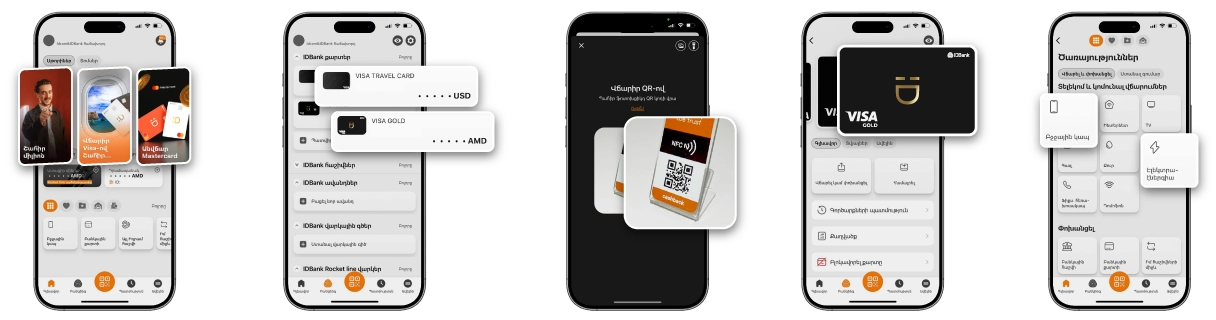

First, the Bank changes its approach to traditional banking and will switch from the model of rendering traditional retail products to a completely new – digital platform, and will introduce modern products in a new banking format to its clients. This fact can be already evidenced by a new direction in the organizational structure of the Bank – the Digital Banking Management, which is responsible for realization of all the new special projects.

Of course, the Bank will not limit its activities by introduction of digital banking tools only, but more attention is anticipated in that direction.

The second important fact is that the Bank conducts an active policy in terms of investment programs. In 2016 for the first time in the history of the Bank it started issuing coupon bonds and has already issued 4 (four) tranches of nominal coupon bonds in USD and AMD with a total amount of 15 mln USD and 1 bln AMD, which were completely placed before the anticipated period. The Bank actively continues its activities in the investment market and has already announced about the emission of the 5th, jubilee tranche of bonds in USD with a total of 5,75% of annual profitability amounting to 5 million USD in total.

In the coming days the Bank will summarize the results of the 3rd quarter. What tendency is observed and has the Bank’s policy changed in terms of lending?

Yes, the Bank has definitely reviewed its lending policy and put and emphasis on financing the economy of the RA. In the upcoming period we are going to temporarily pause international market financing and large investment projects emphasizing the development and financing of the Armenian market thus restraining the possible risks. As a result of this policy the structure of the assets will change and they will slightly decrease, yet we have to admit that in terms of capital and profit the Bank retains its leading position.

Moreover, while making this decision the Bank was guided only by the desire to ensure quality indicators and performance. For example, during the 3rd quarter the capital adequacy ratio of the Bank increased from 33% to almost 38%, thus increasing the security buffer. In the meantime, the performance assessment indicators such as the ROA and ROE have substantially increased, significantly surpassing the average indicators of the banking system.