Question 1. Mr. Abrahamyan, it’s almost a month that you have you been appointed as the CEO of IDBank, have you already outlined those fields or directions you are going to move forward?

Before accepting the proposal, I got acquainted with the vision of the Bank and I must note that the shareholders have chosen such a development plan, which suits to the vision of a modern Bank and it is both realistic and ambitious. After a month of work, I can only confirm that we are on the right way, which is: digitalization, remote services extension, service quality improvement. Our goal is to make banking services as accessible as possible, use technological progress and achieve the perception that the Bank is not just a financial agent; the Bank is a partner that contributes to the convenience of its customers, business development and in general, development of the country's economy.

Question 2․ It is not a secret that you have been employed at the Central Bank for many years and occupied quite responsible and high positions. Though there are similarities with the Central Bank and commercial banks, are there any differences in terms of contacting customers, does this cause difficulties in your work?

It should be mentioned that the main difference is the contrast: the specifics of the public and private sectors, the nature of the work is the same, and as you noted that I have been working in the position of the regulator of the sphere for many years I clearly understand the challenges a commercial bank must currently overcome. Unlike the Central Bank, contacting with the client is the main feature of activities of commercial banks, and as I have already mentioned above, customer satisfaction is one of the strategic goals of IDBank. We will strictly move forward this direction. It is worth mentioning that we have already a huge wave of positive feedback. I am sure, it will even more increase in the near future.

Question 3: What are the indicators of IDBank for 2018?

In 2018 the Bank passed a very important Rubicon successfully rebranding the Bank, and the new brand of the Bank, IDBank is now widely known in our country. As for the financial indicators, 2018 was stable for the Bank, the year was summed up with profit, assets and capital are on the same level compared to 2017, a 10% growth in the loan portfolio was registered.

Question 4․ Are new mergers and acquisitions expected in the financial system, like in 2017?

It is the market, that decides the necessity of mergers and acquisitions, which participants are non-competitive and in what direction the merger should be. In our country, the market is small, the competition is hot, therefore, mergers are certainly possible. It is important here not to have concentrations, no dominant banks, no monopolization of the field. Now we can confidently talk about a non-concentrated market in which there are no monopolies.

Question 5. What are the identifying features of IDBank, how does it differ from the other participants of financial system, particularly other banks?

So far as banking market is one of the most competitive fields, banks are constantly forced to seek and find a position that is more or less free and most beneficial for the Bank. The main identifying feature of IDBank is the quality of provided services, moreover, we are going to appear with new offers and the main goal is to provide simple and accessible services to customers. We have already mentioned multiple times that the Bank has chosen digital banking strategy and is investing large sums to ensure progress and offer competitive products. Therefore, 2019 will be an important, breakthrough year for IDBank and for our customers, who will certainly feel the difference.

Question 6. How do you assess the state of the banking system of RA?

RA banking system is one of the most stable in the region. Against the economic and political stresses of recent years, the banking system of our country resisted without significant problems. On the one hand the reason for this is the Central Bank with its regulator role of the sphere, on the other hand, the banks have a big role in the sustainability of the overall system as major market players. Even during the velvet revolution of 2018 and after that, the loan portfolios of banks grew, the dynamics of deposits was also positive. During 2018 the joint teams of the IMF and the World Bank carried out a regular assessment of the financial system in Armenia, according to which the compliance of our financial system with the best international standards was estimated at 97%, instead of 93%, 67% of last years. This is an extremely high indicator, and very few countries in the world have such high rates.

Question 7․ What new tools will the bank offer to its customers?

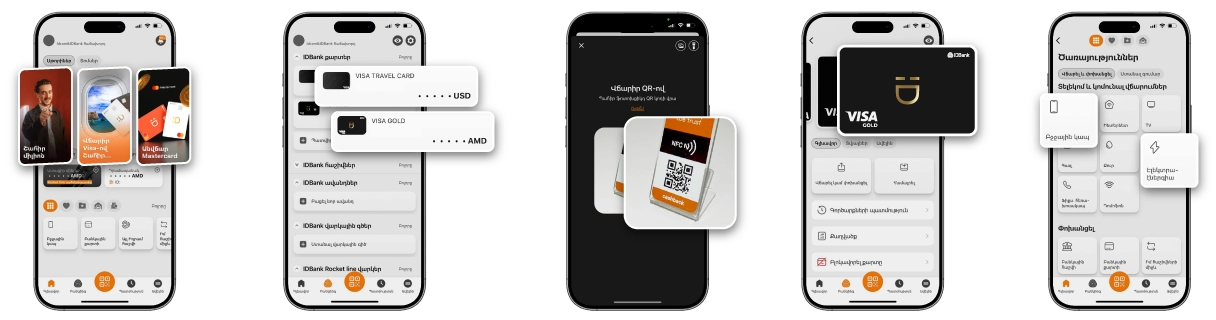

As I have already mentioned in the near future the Bank is planning to develop an Internet banking service and introduce a mobile banking application that will offer customers a wide range of online tools. Remote service is a priority for us, and we will try to offer such opportunities to receive online retail products, which customers are used to get when they visit the branches of the Bank. Soon we are planning to introduce more convenient conditions for mortgage loans, corporate clients can also expect news, in other words, we are trying to create the most up-to-date products that meet the financial needs of clients.

Question 8․ Do you expect development of such technologies in the Armenian banking system in the near future, which will essentially replace employees involved in customer service, like in the USA and RF, where quite a large number of employees have substitutes in the form of new technological solutions?

Indeed, the world already belongs to new technologies, and still, they continue victorious march. It is difficult to imagine the daily usual life without the most diverse technological solutions. And yes, introduction of technologies sometimes means forcing out the human capital from certain work stages. However, we cannot ignore the fact that human beings are the authors of this technological progress. Face to face format of communication is still irreplaceable, especially when there is a group of clients who prefer to visit the branch and make deals in person. Therefore, we are trying to satisfy all our customers, including those who value technological progress and who make use of it, and also those who value human communication.